If you want to buy and sell stocks, you must have a Demat account. Your shares and investment assets are stored digitally in a Demat account, making trading safe, easy, and private. Select the best Demat accounts in India for a smooth buying experience. What should you consider when choosing the best Demat account provider? There are many options, each with its own features, costs, trading platform, and account opening offers. How can you compare them to choose the one that meets your trading needs and fits best?

Don’t worry; we’ll get through this. This blog will help you choose the best Demat account for your needs by exploring several popular options in India based on various factors. Additionally, we will explain how to open a Demat account and what benefits to consider when choosing.

Find the Best Online Demat And Trading Account For You!

Top Stock Broker for free Demat & Trading Account in India 2026

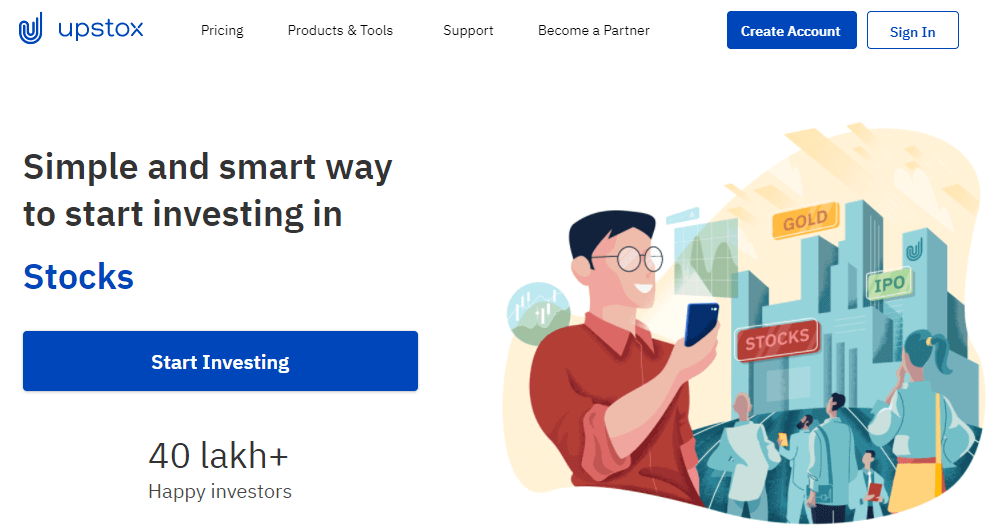

Best for Overall Experience Most Popular – Upstox

|

Note: The selection of the best Demat account may vary depending on individual requirements and priorities. Investors need to conduct thorough research, compare the features and charges of different providers, and assess their own investment goals before finalizing a Demat account provider.

Details Analysis of Top 10 Demat Accounts In India:

#1. Zerodha Demat Account:

Best for trading, investing, cost-effectiveness, & advanced technology.

With over 40 lakh users, Zerodha is the largest and most reputable discount broker. The main reason for Zerodha’s success is its superior customer service, which is superior to that of all other discount brokers.

Zerodha charges a modest brokerage cost of Rs. 20 per completed order, whichever is less. If you trade in large volumes, you can save up to 90% compared to other full-service stockbrokers. Zerodha offers free stock delivery trading.

Popular Discount Broker Upstox

|

Trading platforms with enhanced charts and other tools for enhanced technical analysis are available through Zerodha.

Zerodha Top Features:

- Low-cost brokerage rates

- User-friendly online trading platforms (Zerodha Kite, Zerodha Coin)

- Access to a wide range of financial instruments (stocks, derivatives, commodities, mutual funds, bonds)

- Seamless trading experience

- Competitive pricing compared to traditional brokerage firms

Account Opening Charges & AMC:

- Annual maintenance fees are Rs 300 per year.

Zerodha Brokerage Charges:

- Zero brokerage for equity delivery.

- Intraday equity – 0.03 percent or Rs 20 per executed order.

- Equity futures – 0.03 percent or Rs 20 per executed order.

- Equity options are charged a fixed rate of Rs 20 for each executed order.

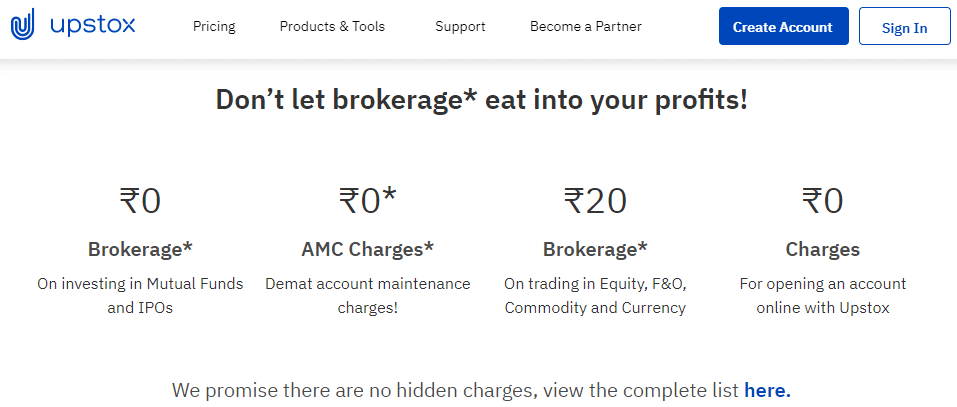

#2. Upstox Demat Account:

Upstox is one of the best discount brokers because of its low brokerage fees, innovative technological platforms, and strong profitability.

Upstox charges a flat fee of Rs. 20 for every intraday deal, regardless of trading volume, with free stock delivery. When compared to other full-service brokers, you may save a significant amount on brokerage fees.

Upstox provides the fastest and finest online trading platform in India, which is a must for traders.

Upstox Account Charges & Fee:

- Opening a Demat and Trading Account with Upstox is completely free (limited-time offer).

- Annual Maintenance Fees for Upstox – Rs. 25 per month.

Upstox Trading Brokerage Charges:

| Trading Segment | Brokerage |

|---|---|

| Equity Delivery | Rs. 0 |

| Equity (Intraday & Futures) | Lower of Rs. 20 per executed order or 0.05% |

| Equity Options | Rs. 20 per executed order |

| Currency Futures & Options | Lower of Rs. 20 per executed order or 0.05% |

| Commodity F & O | Lower of Rs. 20 per executed order or 0.05% |

For more details about Upstox pro please visit Best Trading Platform in India.

Advantages of Upstox:

- For delivery, there are no brokerage fees.

- Exceptional trading platforms.

- Regardless of transaction volume, fixed and low brokerage.

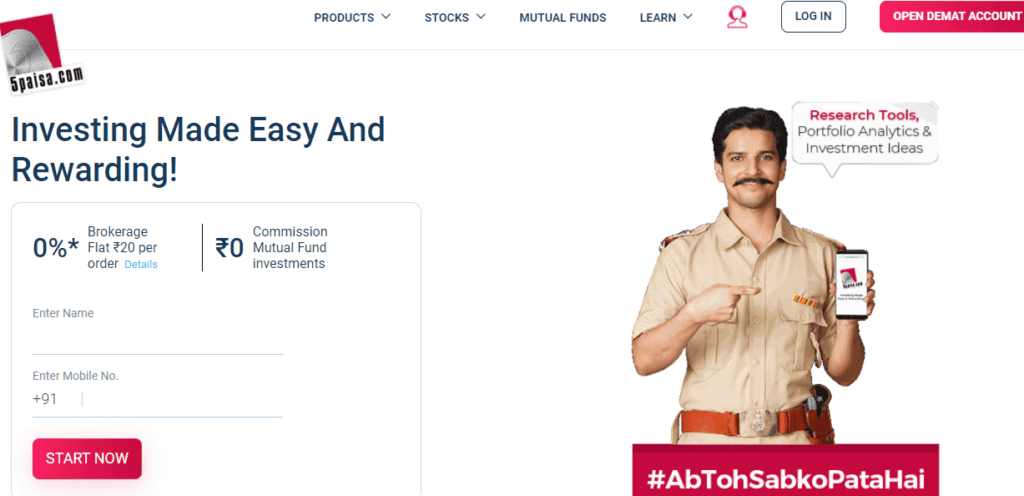

#3. 5Paisa Demat Account:

Under the extra Ultra Trader bundle, 5Paisa charges the lowest brokerage Charges of Rs 10 per trade. You may place a single deal worth crores and pay only Rs 10 in brokerage.

The Ultra trader pack has a monthly cost of Rs. 999. 5Paisa levies a fixed brokerage fee of Rs. 20 for every completed order without the pack.

You may trade using a 5Paisa mobile trading app. In terms of convenience, user experience, and speed, the 5Paisa mobile app is the finest in India.

After providing all of the required documentation, your 5Paisa account will be activated the same day. If you want the cheapest brokerage Demat account, 5Paisa is the way to go.

5Paisa Charges Details:

5paisa provides an all-in-one investing account with two additional packs.

- Rs. 499 per month for the Research & Idea Pack. Brokerage is Rs. 20 per trade, with an AMC of Rs. 45 per month.

- The Ultra Trader Pack costs Rs.999 per month. Brokerage is Rs. 10 per trade, and there are no AMC fees.

- Under the Research & Idea bundle, you simply need to pay maintenance fees for the current month.

- Opening a 5paisa account is completely free.

5paisa Account Open Charges & AMC:

| Account Type | Fee |

|---|---|

| Trading Account Opening Charges (One Time) | Rs 0 |

| Trading Annual Maintenance Charges AMC (Yearly Fee) | Rs 0 (Free) |

| Demat Account Opening Charges (One Time) | Rs 0 (Free) |

| Demat Account Annual Maintenance Charges AMC (Yearly Fee) | Rs 540 (charged as Rs 45 per traded month) |

5Paisa Trading Platforms:

- 5Paisa Trader Station Web: 5Paisa is a low-volume trading platform. The web-based interface makes it simple to view portfolio, position, and holdings data.

- 5Paisa.EXE Trader Terminal: The trader terminal is designed for high-volume traders, with a sophisticated UI and quick execution. You will receive a real-time market price, comprehensive charts with tools, and historical stock prices.

- 5Paisa App: This app allows you to trade on your smartphone with simple access to markets and a wonderful user experience.

For more details please visit the Best Trading App in India.

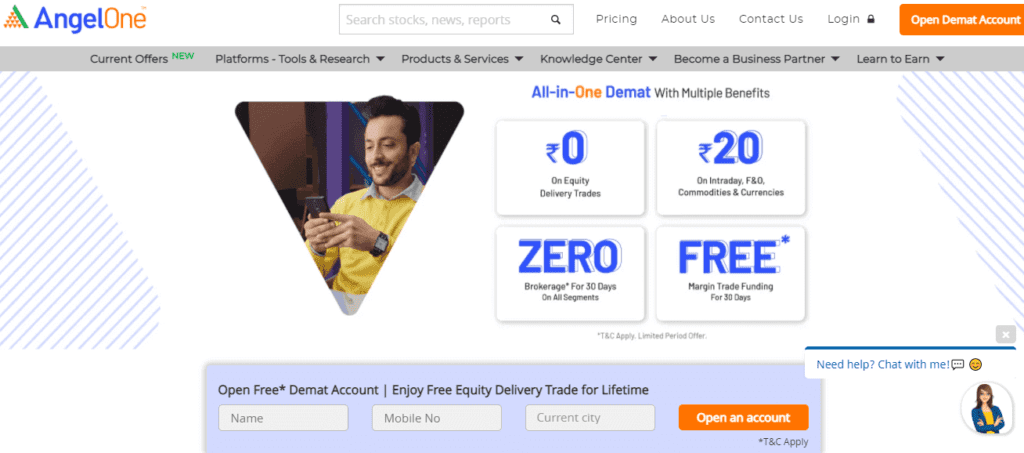

#4. Angel Broking or Angel one Demat Account:

Angel Broking is one of India’s oldest brokerage firms, with 2.15 million brokerage accounts.

Angel Broking’s customer service is excellent. Angel Broking is only recommended if your Adhaar Card is connected to your cellphone phone.

After establishing your identity with an Adhaar OTP, you may complete your whole application online and begin trading.

Account Charges of Angel Broking:

- Opening Fees for a Trading Account – Rs 0.

- Charges for opening a Demat account are Rs 0.

- Annual Maintenance Charges – Rs. 0 for the first year then Rs. 450 per annum.

Angel Broking Provided Trading Platforms:

- Angel Broking Trade: A web-based tool that may be used for portfolio tracking and online trading. The site includes up-to-date market data as well as live news. For deals, I utilize the Angel Broking trade platform.

- Angel Broking Mobile App: ARQ technology is used in the Angel Broking App to provide individualized advice. The software allows you to trade, monitor current market values, and keep track of your portfolio.

- Angel Speed Pro: An installable program that includes 30 days of intraday data and 20 years of historical data. The site incorporates news flash and provides access to a variety of information.

Additional Services:

- A margin of up to ten times the amount deposited is available.

- Through digital KYC, you may begin trading within an hour.

#5. Sharekhan Demat Account:

With over 20 lakh customers, Sharekhan is one of the most popular online brokerage firms. Currently, the organization serves customers via 3200 share stores in 541 cities.

Account Charges of Sharekhan account:

- Trading Account Opening Charges – Nil.

- Demat Account Opening Charges – Nil.

- Annual Maintenance Charges – Rs. 400 per annum (1st year free).

Brokerage Charges:

| Transaction Form | Brokerage |

|---|---|

| Equity (Intraday & Futures) | 0.1% on the 1st leg and 0.02% on the 2nd leg |

| Equity Delivery | 0.50% (min 10 paise) |

| Equity Options | Rs 100 per lot or 2.5% on the premium ( whichever is higher) |

Advantages of Sharekhan:

- There are no account opening fees.

- For the first year, there is no yearly maintenance fee.

- Investors can attend Sharekhan’s online and offline training programs.

- Calling and trading are both free of charge.

Disadvantages:

- On the second leg, there are 0.02 percent brokerage fees.

- When compared to other stockbrokers, the brokerage rate is greater. You can, however, bargain at the time of account opening.

#6. Motilal Oswal Demat Account:

Motilal Oswal offers a wide range of services, including private wealth management, retail brokerage and distribution, institutional broking, asset management, private equity banking, commodities broking, monetary broking, major strategies, and home finance.

The company now has over 2200 business locations and over ten thousand registered clients. The rationale for having a large client base is Motilal Oswal’s robust research-based guidance.

They spend about 10% of their income on research, as well as employing and training research staff. Because I conduct my own research before purchasing any stocks, their research calls are of little use to me.

Account Charges:

- Demat Account Opening Charges – Rs 0.

- Trading Account Opening Charges – Rs 0.

- Annual Maintenance Charges – up to Rs 899 depending on the scheme.

Motilal Oswal Brokerage Charges:

| Segment | Brokerage |

|---|---|

| Equity (Intraday & Futures) | 0.05% |

| Equity Delivery | 0.50% |

| Equity Options | Rs. 70 per lot |

Motilal Oswal Trading Platforms:

- Desktop Trading Platform MO Trader: An installed desktop platform on your PC or laptop. The system enables access across all classes to around 30.000 research reports.

- MO Trader Web Platform – where you may quickly access your trading account online using any web browser.

- MO Trader Mobile App: a mobile platform that provides real-time information and execution for smartphone users.

Advantages of MOSL Demat and Trading account:

- Awarded research advisory encompassing 45 industries and 80,000+ reports.

- There are several value-added services available, such as portfolio management services, FD, gold, US stocks, and bond investing.

#7. India Infoline Demat Account:

IIFL Securities Ltd (IIFL) is a large full-service stockbroker with over 22 lakh customers. The IIFL Demat account is ideal for individuals who want guidance and research assistance while making investment decisions.

For trading and value investing, you would need to pay a percentage-based brokerage fee. IIFL has three brokerage plans: variable brokerage, flat brokerage, and value-added brokerage.

Additional offers:

- Research advisory.

- Market & sector reports & Information.

- Options Trading Using Sensible.

- Loan Products (Home, Personal, Gold, Against Property & Business Loan).

- Mutual Fund Investment.

- Wealth & Financial Management.

Benefits of IIFL Demat Account:

- Account opening is free, and the first year’s AMC is zero.

- Brokerage fees are lower when compared to other full-service brokers.

- 500+ stock research reports, sector summaries, daily stock advice, and recommendations

- IPO and mutual fund investments are examples of value-added services.

IIFL Account Opening Charges:

- Account opening charges – FREE.

- First-year annual maintenance charges – FREE (limited time).

- Annual maintenance charges second year onwards – Rs 250

IIFL Brokerage Charges:

- Stock delivery – Free.

- Intraday, futures & options – Flat Rs 20/trade.

#8. HDFC Securities Demat Account:

HDFC Security Limited is a subsidiary of HDFC Bank, India’s largest private bank. HDFC Securities offers a 3-in-1 account that combines your savings account, trading account, and Demat account.

Account Charges:

- Account Opening Charges – NIL.

- Account Annual Maintenance Charges – Rs 750 ( free for the first year).

Trading Platform of HDFC:

- HDFC Pro Terminal: The HDFC Pro Terminal is a web-based trading tool that provides real-time market data as well as features such as market analysis and sentiment analysis. HDFC charges Rs. 1,999 for the usage of the Pro terminal for a period of 12 months.

- HDFC Securities Mobile Trading: The HDFC mobile platform allows mobile phone users to trade stocks and derivatives in just a few clicks.

- Disadvantages:

Advantages:

- Funds may be readily transferred from one account to another to interconnected accounts. Only useful for HDFC saving account holders.

Disadvantages:

- Commodity trading is not available through HDFC security.

- If you are a new HDFC member, you must first create a savings account.

- The use of the Pro trading terminal costs Rs. 1,999.

#9. Kotak Securities Demat Account:

Kotak Securities is the brokerage division of its parent company, Kotak Mahindra Bank.

They provide services in a variety of markets, including stocks, derivatives, ETFs, currencies, and portfolio management.

They have a clientele of over 12 lakhs. Their branches and franchisees may be found in over 1200 sites in 360+ cities and towns.

Kotak Securities Brokerage Structure:

They have two brokerage Plans. Dynamic Plan, and Advance Brokerage Plan.

- Dynamic Brokerage Plan:

| Delivery Trading (Monthly Volume) | Brokerage Charges |

|---|---|

| Less than 1 Lakh | 0.59% |

| 1-5 Lakh | 0.55% |

| 5-10 Lakh | 0.45% |

| 10-20 Lakh | 0.36% |

| 20-60 Lakh | 0.27% |

| 60 Lakh- 2 Crores | 0.23% |

| Greater than 2 Crores | 0.18Brokerage Charges% |

| Intraday Trading | Brokerage Charges |

|---|---|

| Less than 25 Lakhs | 0.06% |

| 25 Lakhs- 2 Crores | 0.05% |

| 2 Crores – 5 Crores | 0.04% |

| More than 5 Crores | 0.03% |

Kotak Securities Demat Account Opening and AMC Charges:

- Trading Account Opening Charges: Rs 750

- Demat Account Maintenance Charges: Rs 50 per month.

Advantages of Kotak Demat & Trading Account:

Pros:

- They provide a 3-in-1 Demat account that allows for the smooth transfer of payments.

- All investing options are available under one roof.

- Above-average trading platforms, as well as support for traders with sluggish internet connections

- Online chat with the support team is available.

Cons:

- There is no support for the commodities segment.

- Brokerage fees are exorbitant, even when compared to comparable full-service brokers.

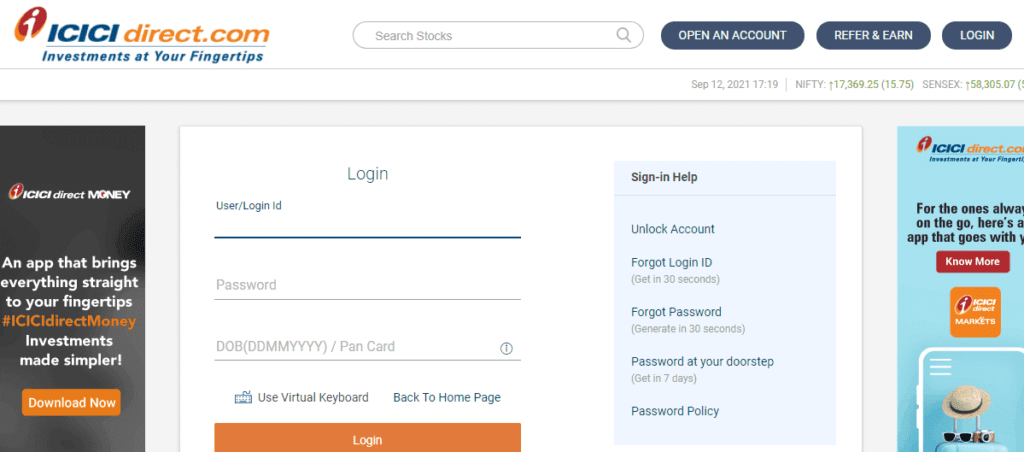

#10. ICICI Direct Demat Account:

ICICI Direct is a large stock brokerage firm with over 20 lakh customers. ICICI Direct offers a diverse range of services and investment opportunities, including.

- Investing in stocks, derivatives, mutual funds, initial public offerings (IPOs), NCDs and bonds, ETFs, and currencies.

- Products of great value. Investment in E-Locker and NPS.

- Home loans and loans secured by securities.

Additional offers:

- If your trading volume is minimal, the ICICI Direct account is ideal.

- If you already have an ICICI saving account and wish to invest in IPOs and mutual funds, you may do so.

- You will get a 3-in-1 account, which includes a savings account, a trading account, and a Demat account all rolled into one.

- The 3-in-1 account allows for simple money transfers in and out.

ICICI Direct offers 3 types of brokerage plans:

- ICICI direct Prime:

| Prime plan in Rs. | Cash | Equity Futures | Equity Options per lot | Currency Futures | Currency Options |

|---|---|---|---|---|---|

| 900 | 0.25% | 0.025% | Rs. 35 | Rs. 20 per order & Rs. 2 per lot | Rs. 20 per order & Rs. 2 per lot |

| 4,500 | 0.18% | 0.018% | Rs. 25 | Rs. 20 per order & Rs. 2 per lot | Rs. 20 per order & Rs. 2 per lot |

| 9,500 | 0.15% | 0.015% | Rs. 20 | Rs. 20 per order & Rs. 2 per lot | Rs. 20 per order & Rs. 2 per lot |

- I- Secure Plan: Where a fixed percentage of brokerage of 0.55% is charged on turnover.

- Prepaid Brokerage Plan:

| Prepaid plan in Rs | Cash | Equity Futures | Equity Options per lot | Currency (F&O) |

|---|---|---|---|---|

| 5000 | 0.25% | 0.025% | Rs. 35 | Rs. 20 per order & Rs. 2 per lot |

| 12,500 | 0.22% | 0.022% | Rs. 30 | Rs. 20 per order & Rs. 2 per lot |

| 25,000 | 0.18% | 0.018% | Rs. 25 | Rs. 20 per order & Rs. 2 per lot |

| 50,000 | 0.15% | 0.015% | Rs. 20 | Rs. 20 per order & Rs. 2 per lot |

| 1,00,000 | 0.12% | 0.012% | Rs. 15 | Rs. 20 per order & Rs. 2 per lot |

| 1,50,000 | 0.09% | 0.009% | Rs. 10 | Rs. 20 per order & Rs. 2 per lot |

ICICI Direct Account Charges:

- Account Opening Charges- up to Rs. 975 depending on the scheme.

- Annual Maintenance Charges – Rs 700 (1st year free).

ICICI Direct Trading Platforms:

- Trade Racer Web: A web-based platform that allows you to do all trading and investment operations. Any browser may access the online platform.

- Trade Racer Desktop: An installable trading platform that includes features such as live-streaming quotations and research calls, as well as an integrated fund transfer mechanism.

How to Choose the Best Demat Account?

To choose the best demat account, follow these key steps:

- Research: Conduct research on different demat account providers and compare their features, charges, and reputation.

- Assess Your Needs: Determine your investment goals, preferred investment options, and the level of customer support you require.

- Security and Regulations: Ensure the demat account provider is trustworthy, reliable, and regulated. Look for robust security measures.

- Cost Consideration: Evaluate the charges associated with the demat account, including account opening fees, maintenance charges, and transaction fees.

- User-Friendly Interface: Opt for a Demat account with an intuitive and easy-to-use interface that provides real-time market data and order placement.

- Customer Support: Consider the quality and responsiveness of customer support, ensuring multiple channels are available for assistance.

- Integration with Trading Account: If you have or plan to open a trading account, ensure compatibility and integration between the demat and trading accounts.

- Recommendations and Reviews: Seek recommendations from experienced investors and pay attention to user reviews and ratings.

- Additional Services: Consider additional services provided, such as IPO applications, research reports, or educational resources.

- Account Opening Process: Evaluate the account opening process, preferring providers with convenient online account opening options.

By following these steps, you can make an informed decision and choose the best Demat account in India that meets your specific investment requirements and preferences.

Conclusion:

When choosing the top demat account in India, it’s crucial to assess your investment goals, trading preferences, and the specific features and services that align with your needs. Consider factors such as account opening charges, brokerage fees, AMC, research reports, trading platforms, and customer support to make an informed decision that suits your investment requirements.

Demat Account vs Trading Account:

-

Demat Account

-

Trading Account

-

Differences

-

Integration with Brokers:

-

Types of Accounts

-

Pros & Cons

-

Dematerialization & Its Benefits

-

Account Opening: Easy Steps

-

Demat Account Charges & fees

-

Use of Demat Account

Definition and Purpose of Demat Account:

- A Demat account, short for dematerialized account, is an electronic account that holds your securities in a dematerialized form.

- Its purpose is to eliminate the need for physical share certificates by converting them into electronic format, ensuring easy storage, accessibility, and transfer of securities.

Key Features of Demat Accounts:

- Electronic Storage of Securities: Demat accounts provide a secure platform for holding various financial instruments, including stocks, bonds, mutual funds, ETFs, and government securities.

- Safe and Convenient Transactions: Buying, selling, and transferring securities becomes seamless, with the demat account acting as a repository for your holdings.

- Reduced Paperwork and Risks: Dematerialization eliminates the risks associated with physical share certificates, such as loss, theft, and damage.

- Real-Time Portfolio Tracking: Demat accounts offer real-time updates on your holdings, allowing you to monitor their performance and value.

Definition and Purpose Of Trading Account:

- A trading account is specifically designed for executing buy and sell transactions in financial markets, such as stocks, derivatives, commodities, and currencies.

- It acts as a gateway to access the market, allowing you to place orders and participate in trading activities.

Key Features Of Trading Account:

- Order Placement and Execution: Trading accounts enable you to place different types of orders, including market orders, limit orders, and stop-loss orders, to buy or sell securities at desired prices.

- Market Data and Analysis: Trading accounts provide access to real-time market data, charts, and analysis tools, helping you make informed investment decisions.

- Margin Trading: Some trading accounts offer the option of margin trading, allowing you to trade with borrowed funds and potentially amplify your returns.

- Settlement of Trades: Trading accounts facilitate the settlement of trades by debiting or crediting the respective demat account for the securities bought or sold.

Differences Between Demat And Trading Accounts:

- A Demat account focuses on holding securities, while a Trading account is used for executing trades.

- A Demat account ensures secure storage and transfer of securities, while a Trading account facilitates buying and selling of securities.

- A Demat account helps track the value of your investments, while a Trading account provides tools for active trading.

Interconnection:

- Demat and trading accounts work together to facilitate seamless investment activities.

- Securities held in the Demat account are utilized for trading through the trading account.

- The integration streamlines buying, selling, and settling trades.

- Typically, demat and trading accounts are provided by the same financial institution or brokerage firm, ensuring seamless integration between the two accounts.

- This integration streamlines the process of buying, selling, and settling trades, as the securities held in the Demat account can be directly utilized for trading through the trading account.

Types of Demat Accounts in India:

- Regular Demat Account: Standard account for individual investors to hold and trade securities.

- NRI Demat Account: Specifically for Non-Resident Indians (NRIs) to invest in Indian securities.

- Repatriable Demat Account: Allows repatriation of funds from the sale of securities by NRIs.

- Non-Repatriable Demat Account: This does not permit the repatriation of funds from the sale of securities by NRIs.

Types of Trading Accounts in India:

- Equity Trading Account: Enables buying and selling of stocks and equity-related instruments in the stock market.

- Derivatives Trading Account: Facilitates trading in derivatives such as futures and options contracts.

- Commodity Trading Account: Designed for trading commodities like gold, silver, agricultural products, etc., in commodity exchanges.

- Currency Trading Account: Allows trading in currency pairs in the foreign exchange market.

- IPO Trading Account: Specifically for participating in Initial Public Offerings (IPOs) and subscribing to new securities.

These are some of the common types of demat and trading accounts available in India. It's important to consider your investment needs and consult with financial institutions or brokerage firms to choose the most suitable account type for your requirements.

Advantages of Demat Account:

- Easy storage and management of securities in electronic format.

- Eliminates the risks associated with physical share certificates, such as loss, theft, and damage.

- Facilitates seamless transfer of securities.

- Provides real-time portfolio tracking and updates.

- Reduces paperwork and administrative burden.

- Enables participation in various investment options, including stocks, bonds, mutual funds, and ETFs.

Disadvantages of Demat Account:

- Incurs certain charges, such as account opening fees, annual maintenance charges, and transaction fees.

- Requires a reliable internet connection for online access and transactions.

- May involve complexities related to account opening and compliance procedures.

- Dependency on the functioning of the depository participant (DP) and technological infrastructure.

Advantages of Trading Account:

- Enables buying and selling of securities in the financial markets.

- Provides access to real-time market data, charts, and analysis tools for informed decision-making.

- Offers different types of orders for precise trading strategies.

- Allows investors to take advantage of market fluctuations and investment opportunities.

- Provides options for margin trading, leveraging investment potential.

- Facilitates quick settlement of trades and fund transfers.

Disadvantages of Trading Account:

- Involves market risks and potential losses due to market volatility.

- Requires knowledge and understanding of market dynamics and trading strategies.

- May incur brokerage charges, transaction fees, and other related costs.

- Requires continuous monitoring of market trends and investment positions.

- Emotional biases and impulsive decision-making can impact investment outcomes.

What is Dematerialization? & Its Benefits:

Dematerialization refers to the process of converting physical securities, such as shares and bonds, into electronic form. In India, this process is facilitated through a Demat account, which holds these electronic securities.

Benefits of Dematerialization:

- Elimination of Physical Certificates: Dematerialization eliminates the need for physical share certificates, reducing the risk of loss, theft, damage, or forgery. It provides a secure and convenient way to hold and manage securities.

- Ease of Transfer: Electronic securities held in a Demat account can be easily and quickly transferred between accounts through electronic means. This simplifies the process of buying, selling, and transferring securities, enhancing liquidity and efficiency.

- Reduced Paperwork: Dematerialization significantly reduces the paperwork involved in the handling of physical certificates. It eliminates the need for filling out transfer deeds, submitting share certificates, and waiting for their verification and processing.

- Lower Costs: Holding securities in electronic form reduces costs associated with printing, handling, storing, and distributing physical certificates. Additionally, transaction fees for electronic transfers are often lower compared to the costs involved in physical transfers.

- Faster Settlement: Dematerialization allows for faster settlement of trades. The electronic transfer of securities enables seamless and speedy settlement, reducing the time required for transactions and enabling investors to access their funds and securities more quickly.

- Increased Accessibility: With Demat accounts, investors can access their holdings and track their portfolios online. They can view their account statements, transaction history, and portfolio valuation at any time, providing greater transparency and control over their investments.

- Integration with Other Financial Services: Demat accounts can be integrated with various financial services such as online trading platforms, initial public offerings (IPOs), mutual fund investments, and corporate actions like dividends and bonuses, providing a seamless and integrated investment experience.

Overall, dematerialization simplifies and streamlines the process of holding, trading, and managing securities, offering convenience, safety, and cost efficiency to investors.

Here's a simplified version of opening a Demat account in India in four steps:

- Choose a Depository Participant (DP): Select a registered DP, such as a bank or brokerage firm.

- Fill the Account Opening Form (AOF): Obtain the AOF from the DP and complete it with accurate personal and bank details.

- Submit Documents: Provide the necessary documents, including proof of identity like Aadhar, PAN, proof of address, and photographs.

- Complete KYC Process: Undergo the KYC process, which involves verifying your identity and address through in-person or video verification.

After these steps, your Demat account will be opened, and you'll receive your account details. Ensure to link your Demat account with a bank account for seamless trading and investing.

Demat account charges in India typically include:

- Account Opening Charges: One-time fee for opening a Demat account, which varies across Depository Participants (DPs).

- Annual Maintenance Charges (AMC): Yearly fee for maintaining the Demat account. The AMC amount varies depending on the DP and the type of account (individual or corporate).

- Transaction Charges: Fees charged for buying or selling securities. Transaction charges differ based on the type and value of the transaction.

- Dematerialization Charges: Fees levied for converting physical securities into electronic form.

- Rematerialization Charges: Charges applicable for converting electronic securities back into physical certificates.

It is important to note that these charges may vary between DPs, and investors should check with their chosen DP for specific details on the charges and any additional fees that may apply.

The primary use of a Demat account is to hold and manage securities in electronic form. Here are some key uses of a Demat account:

- Holding Securities: A Demat account allows individuals to hold various types of securities electronically, including stocks, bonds, mutual fund units, government securities, and exchange-traded funds (ETFs). Instead of physical share certificates or bond papers, these securities are held in digital format.

- Buying and Selling Securities: With a Demat account, investors can easily buy and sell securities in the stock market. They can place orders online or through a broker, and the transactions are executed electronically. The bought securities are credited to the Demat account, and the sold securities are debited from it.

- Safe and Secure Storage: Dematerialization eliminates the risk of loss, theft, or damage associated with physical securities. The Demat account provides a secure and centralized storage solution for investors to safeguard their investments.

- Portfolio Management: The Demat account provides investors with a consolidated view of their holdings. They can easily track and manage their portfolio, monitor the performance of their investments, and access real-time market updates and account statements online.

- Online Trading and Investing: A Demat account is usually linked to an online trading platform, enabling investors to trade and invest in securities online. They can place buy and sell orders, track market trends, analyze stock performance, and execute transactions conveniently from their computer or mobile device.

- Dividends and Corporate Actions: Dividends, interest, and other corporate actions such as bonus issues, rights issues, and stock splits are automatically credited to the Demat account. Investors can easily track and access these benefits without the need for physical paperwork.

- Loan against Securities: Some financial institutions allow individuals to avail of loans by pledging securities held in their Demat account as collateral. This feature provides liquidity to investors without the need to sell their securities.

Overall, a Demat account simplifies the process of holding, trading, and managing securities, offering convenience, safety, and ease of access to investors in the Indian financial market.

Frequently Asked Questions:

Which brokerage has the lowest fees in India?

Zerodha & Upstox is a popular brokerage house in India known for its low fees and discount brokerage model. They offer commission-free equity investments and charge a flat fee for other trades, making them one of the lowest-cost options for investors in India.

Which Demat account is best for beginners in India?

Which Demat account is the best and cheapest in India?

Upstox, Zerodha, and 5Paisa are considered one of the best and cheapest Demat account providers in India. They are a leading discount broker known for their low brokerage fees and user-friendly platform.

Which Demat account is free of cost?

Typically, Demat accounts in India are not completely free of cost. However, there are certain brokers that offer zero account opening charges for Demat accounts. Zerodha & Upstox is such broker that offers zero account opening charges for Demat accounts. However, it’s important to note that there may still be charges associated with other services such as transaction charges, annual maintenance charges (AMC), and other applicable fees.

Which is the best Demat account for small investors?

There are several Demat account providers that cater to small investors. Some popular options include Zerodha, Upstox, and 5Paisa. These platforms offer low brokerage fees, user-friendly interfaces, and a range of investment options. However, the “best” Demat account for a small investor ultimately depends on individual preferences and requirements. It’s advisable to compare the features, charges, customer support, and reviews of different providers to determine which one aligns best with your specific needs.

Which is the best demat account for Mutual Funds?

Many Demat account providers offer the facility to invest in Mutual Funds. Some of the well-known platforms that are popular for Mutual Fund investments include Zerodha Coin, HDFC Securities, ICICI Direct, and Groww. These platforms typically provide a wide range of Mutual Funds to choose from, easy navigation, user-friendly interfaces and often offer features like goal-based investing, SIP (Systematic Investment Plan), and tracking portfolio performance. However, the “best” Demat account for Mutual Funds depends on individual requirements and preferences. It’s advisable to compare the features, charges, customer support, and reviews of different providers to determine which one suits your needs and offers the Mutual Fund options you are interested in.

Which is the best 3 in 1 Demat account?

ICICI Direct, HDFC Securities, and Kotak Securities are among the popular options for 3-in-1 Demat accounts.

Which is the best Demat account for traders?

For traders, the best Demat account would depend on their specific trading preferences, strategies, and requirements. Some popular Demat account providers that are commonly used by traders include Zerodha, Upstox, Sharekhan, and ICICI Direct. These platforms typically offer advanced trading tools, fast order execution, real-time market data, technical analysis tools, and various trading platforms (web, mobile, desktop) to cater to different trading styles. It’s advisable for traders to compare the features, charges, customer support, and reviews of different providers to determine which one aligns best with their trading needs.

Is the Demat account safe?

Yes, Demat accounts are considered safe due to regulatory oversight, elimination of physical certificates, secure infrastructure, account segregation, and investor protection mechanisms.

Can I open 2 Demat accounts with the same bank account?

Yes, it is possible to open multiple Demat accounts with the same bank account.

Can I have multiple Demat Accounts?

Yes, you can have multiple Demat accounts. There is no restriction on the number of Demat accounts an individual can hold. However, it’s important to note that maintaining multiple Demat accounts may involve additional administrative work and can incur extra charges such as account maintenance fees. It’s advisable to assess your investment needs and consider the convenience and cost implications before deciding to open multiple Demat accounts.

Can I Buy Shares without a Demat account?

No, you cannot buy shares without a Demat account. A Demat account is necessary to hold and trade shares in electronic form. When you purchase shares, they are credited to your Demat account, and when you sell shares, they are debited from your Demat account. It serves as a digital repository for your securities holdings, eliminating the need for physical share certificates. Therefore, to participate in the stock market and buy shares, you must have a Demat account.

Can I have multiple Demat Accounts with the same stockbroker?

You cannot open multiple Demat accounts with the same Depository Participant (DP) or broker. Each Demat account you hold will incur separate charges for annual maintenance. Additionally, not utilizing a Demat account may result in charges and potential account freezing.