In the fast-changing world of online stock trading, investors and traders in India need to have the best trading platform. These platforms are essential tools for executing trades, analyzing market trends, and managing investment portfolios. They provide real-time market data, advanced charts, order placement options, and other features that enhance the stock trading experience.

Find the Best Online Trading Platforms For You!

India’s financial markets are teeming with brokerage firms and financial institutions offering trading platforms with various features and functionalities. The best trading platforms in India not only provide a user-friendly interface but also offer comprehensive market analysis, research tools, customizable watchlists, and seamless trade execution.

Selecting the right trading platform is essential as it directly impacts an individual’s ability to make informed trading decisions, monitor investments, and execute trades efficiently. In this article, we will explore the features and qualities of the best trading platforms in India, helping traders and investors choose the most suitable platform based on their specific trading preferences and requirements.

Our Top Pick Stockbroker for Trading Platform in India

It is important to note that the selection of the best trading platform may vary depending on individual needs, trading strategies, and preferences. Traders and investors should conduct thorough research, compare the features and costs of different platforms, and consider factors such as reliability, speed, ease of use, customer support, and available market analysis tools before making a final decision on their trading platform provider.

What is a trading platform?

A trading platform is a software tool or online platform that enables investors and traders to buy, sell, and manage various financial instruments such as stocks, bonds, commodities, and derivatives. It provides access to real-time market data, allows users to place orders, provides charts and analysis tools, and facilitates trade execution. Trading platforms are essential for executing trades and monitoring investments in the financial markets.

Types of Online Stock Trading Platforms in India:

There are Mainly Three types of online Stock trading platforms in India that are used by stock traders and investors.

- Desktop Trading Platforms: Installed on computers, offering advanced features, charting tools, and order placement capabilities.

- Web-based Trading Platforms: Accessed via web browsers, providing flexibility and convenience with essential trading features.

- Mobile Trading Platforms (Mobile Trading Apps): Designed for smartphones and tablets, allowing on-the-go access to trading, portfolio management, and real-time data.

List of Top 10 Best Trading Platforms in India 2024:

| Rank | Trading Platform | Ratings |

|---|---|---|

| 1 | Zerodha KITE | 9.68/10 |

| 2 | Angel One Speed PRO | 9.53/10 |

| 3 | Upstox PRO | 9.41/10 |

| 4 | 5Paisa Trader Terminal | 8.95/10 |

| 5 | Sharekhan Trade Tiger | 8.89/10 |

| 6 | FYERS ONE | 8.78/10 |

| 7 | MOSL Trader | 8.69/10 |

| 8 | ICIC Trade Racer | 8.68/10 |

| 9 | NSE NOW | 8.62/10 |

| 10 | Kotak Securities KEAT Pro X | 8.59/10 |

Details Analysis of Top Trading Platforms in India 2024:

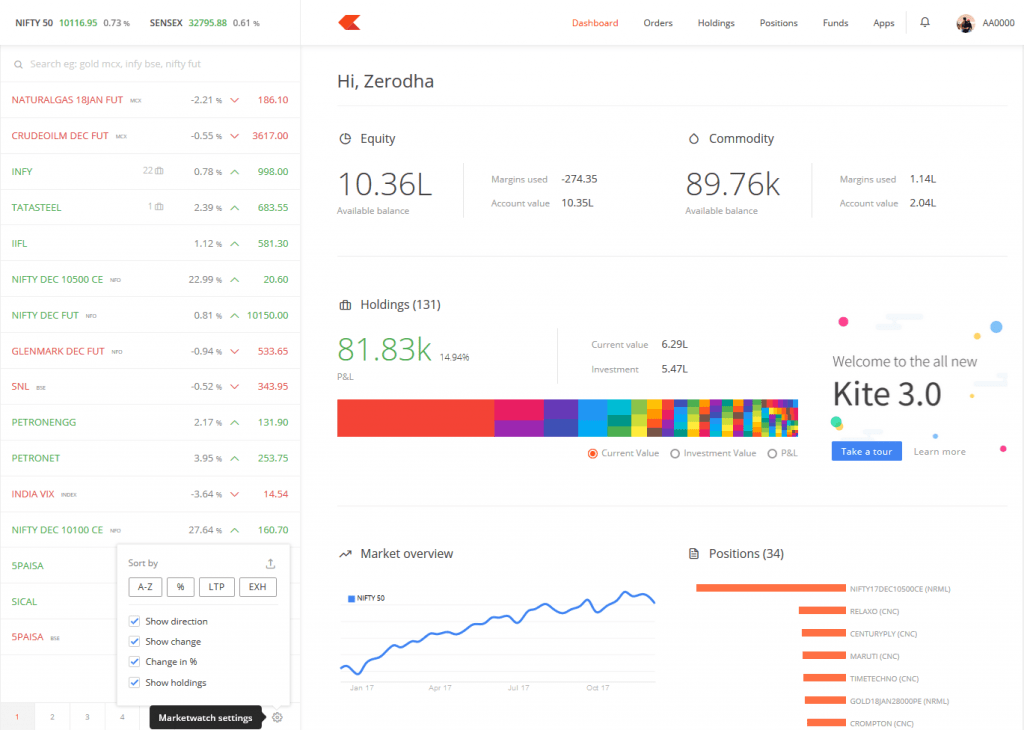

#1 Zerodha KITE 3.0 Trading Platform:

Zerodha, India’s Top discount broker, has launched KITE, an online trading platform for web, and Mobile trading platforms. Previously, they offered Omnesys Technology’s NEST software as a reconstructed image.

KITE was built in-house by the Zerodha group from the ground up, so any faults would be immediately resolved.

Kite provides comprehensive Marketwatch, detailed charts with over 100 Plus indicators, and six different chart formats. You get access to significant history price data for equities and F&O contracts to improve trading.

Zerodha Kite is an online trading platform that uses less than 0.5 kbps of bandwidth. That there were no particular system specifications, however, a fast internet connection is required.

Kite allows users to browse and trade 90,000+ equities and futures and options contracts across several exchanges.

Covering orders may be placed in milliseconds just on site. You may also see 20 strategic benefits (trade quotes) to determine liquidity in the market and trade appropriately.

Kite comes with a user-friendly, streamlined interface that allows you to analyze, trade, and maintain your account in your unique style.

Advantages:

- It’s light, intuitive, and gives you the best possible user experience.

- Due to its modest resource requirements, it may be used without difficulty by clients from remote locations with sluggish internet speeds.

- For effective trading, you’ll need a lot of indicators, charts, and other tools.

- Within the interface, you may transfer money between several banks.

#2 Angel One PRO Trading Platform:

Angel Speed Pro is another best trading Platform from Angel One, one of India’s most well-known stock brokers. Because it is a desktop program, it must be loaded by downloading the executable file.

Angel Broking or Angel One used to charge brokerage on a percentage basis before 2019. However, they are currently adopting the Zerodha cheap brokerage strategy.

For technical research and trading, the Angel app includes over 40 fundamental visual signals and overlays.

Angel’s ARQ tool for boosting asset quality is included within the app.

The company costs Rs20 per trade, with no brokerage fees for delivery trades.

Advantages:

- The program offers a simple and easy-to-use UI.

- I enjoy the previously mentioned multi-desktop functionality.

- It is possible to apply for mutual funds directly from the tool.

- Shortcut keys of one’s choice can be configured for rapid transactions.

- It is possible to set up alerts depending on client parameters.

Disadvantages:

- Bonds and IPOs are not available for investment.

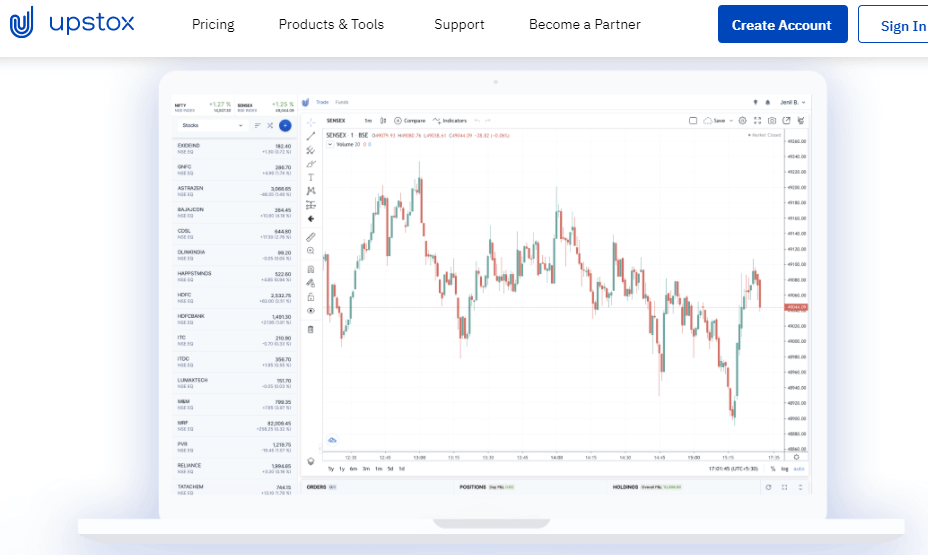

#3 Upstox PRO Trading Platform:

Upstox Pro is the company’s most advanced web and best mobile trading platform. RKSV Securities was their previous name.

The program employs a technique known as socket technology, which allows for real-time access to market data.

One unique feature of Upstox Pro is that you can place orders directly from the chart by right-clicking on it. This allows us to focus on charts instead of symbols, which helps us avoid making dumb mistakes while placing orders.

The charting may be configured to historical data. It also includes more than ten sketching tools and more than 100+ indicators.

It also included ten years of historical chart data. If you’re putting any of your trading strategies to the test, it’s a good idea to look at how they’ve performed in the past.

It also includes a lovely function known as drag & drop. Simply drag the scrip name from the left column to the charting window in the center. The chart of that specific script also will appear in the charting window.

Advantages:

- Charts that may be customized with over 100 indications

- Personalize the platform using widgets.

- Make a chart-based order

Disadvantages:

- This software does not allow you to invest in mutual funds (Equity, Currency, and Commodity are supported)

- There are a few software problems, however, they are constantly updating the program.

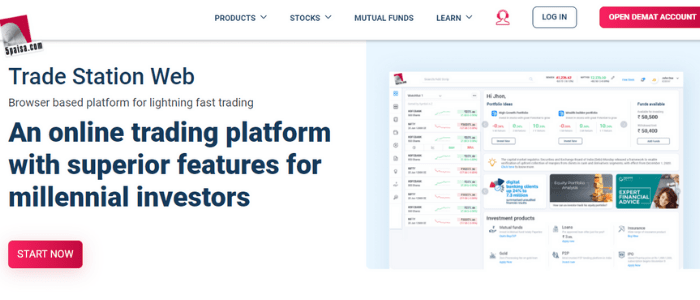

#4 5Paisa – Trader Terminal Trading Platform:

5Paisa is a discount broker. The name of their trading platform is “Trader Terminal,” and it gives an excellent user experience.

The 5Paisa Trader Terminal is designed to provide you with quick access to almost all of 5Paisa’s services.

When compared to platforms that are based on the Internet. Because they are speedier, desktop-based trading systems are ideally suited for day traders.

You must get an a.exe file from their website and install it on your computer.

Advantages:

- The terminal may be used to access the suggestions.

- Mutual funds and insurance divisions are available for investment.

- Users can make rapid decisions with the support of rich technical research and basic facts.

- It runs smoothly since it doesn’t take up a lot of memory on the computer.

- Traders can alter the UI to their liking.

Disadvantages:

- Because it’s a newly released platform, there may be some stability concerns.

- There are no third-party items integrated.

#5 Sharekhan Trade Tiger Trading Platform:

My favorite charting tool is Sharekhan’s TradeTiger, simply because I’ve been using it for a long time. With a single click, you may place multiple orders, group orders, and bulk orders. The site allows you to specify order amount by actual amount, trade value, or current market price, allowing you to trade according to your choices.

Trade Tiger provides you with intraday and daily charts as well as over 30+ indicators and studies. Additionally, you may open many charts and link them together by period, scrip, or exchange. Take a look at the Sharekhan review.

Option quotes from Trade Tiger also include then 30 trading techniques, portfolio Greeks, and pay-off charts. It is also possible to export market share within existing data streams to Excel and start trading from the spreadsheet.

Advanced charting features allow you to design entry, target, and exit lines as well as execute trades right from the charts.

Advantages:

- Direct trading from Excel.

- Trading with the use of heat maps.

- Multiple charts can be linked together.

- Make a chart-based order.

Disadvantages:

- There are just 30 indicators and research available.

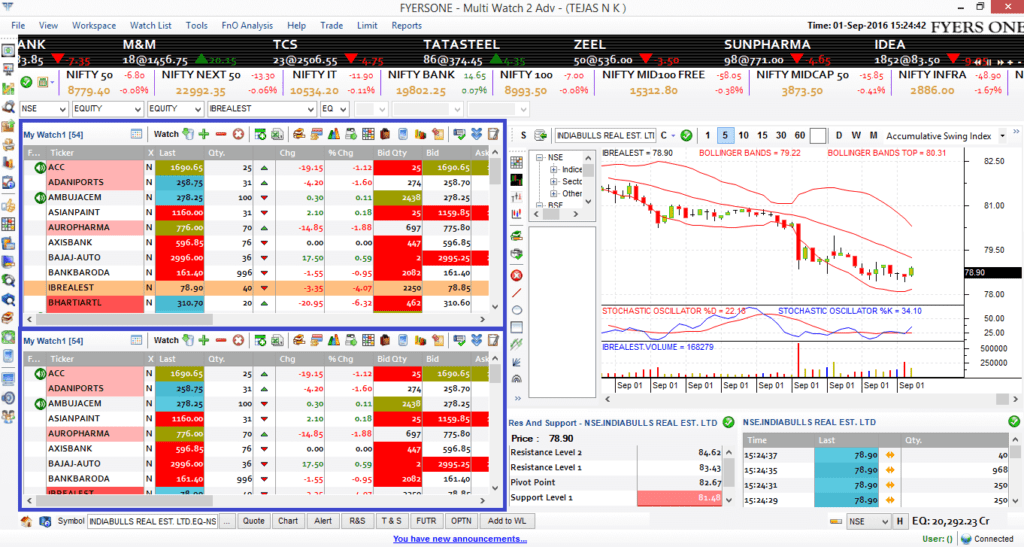

#6 FYERS ONE Trading Platform:

FYERS ONE is a desktop-based trading tool developed by a Bengaluru-based discount broker. FYERS, interestingly, has placed a high value on its trading platforms from the start.

The finest aspect of their program that I enjoy is the screener. It can search and set up good trade chances. You can check a stock that has gapped up by a given percentage from the previous day’s peak, for example.

Advanced charting is available on the site, with end-of-day data going back ten years and intraday (1 to 5-minute) charts going back 30 days.

The fundamental analysis may be done in the same way; one may check with the needed PE ratio, market cap, and returns data.

They’ve put a lot of money into developing one of India’s best trading platforms.

To undertake in-depth technical analysis, traders can use more than 60 indicators and research.

Traders may use Fryers One’s “Heat map,” “Market dynamics,” and “Index meter” features to instantly analyze market movements.

Fryers One has ten customized workspaces with straightforward designs where you can create a watchlist based on sectors, indexes, and derivatives.

Advantages:

- Ten workstations that may be customized Trading analysis using heat maps.

- Charts with a 30-day history for intraday trading.

Disadvantages:

- It is not feasible to trade from charts.

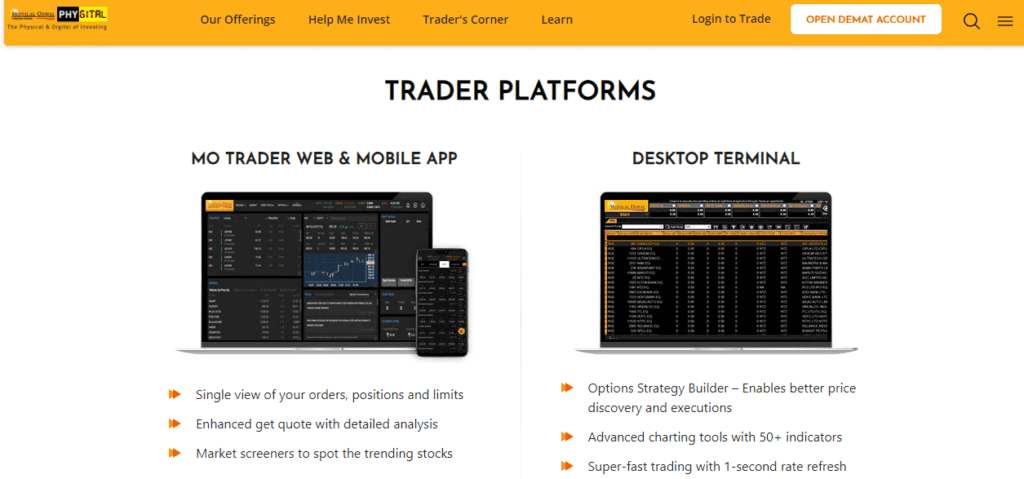

#7 MOSL Trader Trading Platform:

Motilal Oswal is a full-service brokerage firm that specializes in research advising and a wide range of financial products. So when you trade, you have reliable research-based advice and access to over 30,000 research studies.

For technical analysis and study, the platform provides over 40 customizable charting indicators.

Motilal Oswal’s Orion Lite is a desktop trading platform with a 1-second rate refresh.

Orion Lite from Motilal Oswal offers a unique “Trade Guide Signal” technology that produces buy/sell recommendations automatically.

“Option Writer,” which advises users whether or not to write options, and “Option Decoder,” which allows us to monitor and control your options portfolio, are both useful tools for options traders.

For stocks, derivatives, currency, and commodities, the desktop may be configured to track and create multi-asset watch lists.

Advantages:

- While trading, you get access to over 30,000 research studies.

- 40 charting indicators that may be customized.

- Option trading tools such as Option Writer and Decoder.

- Multi-asset timepiece.

Disadvantages:

- It is not possible to trade directly from the charts.

- There are too many trade ideas SMS.

#8 ICIC Trade Racer Trading Platform:

ICICI Direct Trade Racer is a powerful trading tool from India’s largest stockbroker, ICICI Direct. They are the brokerage arm of ICICI Bank and have played an important role in popularising internet trading in Indian stock markets.

Again, Trade Racer is a terminal-based trading platform, therefore it must be installed before usage. It is available for download on their website.

TradeRacer offers live-streaming quotations and research calls, as well as different watchlists.

This program has a Trend Scanner feature: It is essentially a scanner that assists traders in locating trending scrips based on the conditions stated.

You also have access to their basic and technical calls via the “iClick2Gain” module.

The user interface is very customizable. Colors, grids, and layouts may all be customized. It has three views: “Analytical View,” “Derivative View,” and “Equity View.” I believe that names are self-explanatory and that you can deduce what they imply.

Some additional features, such as a heat map and a live screener, are also offered.

- With a 1-second refresh rate, trade execution is lightning quick.

- In a single script, there are over 40 technical indications.

- To select the ideal portfolio mix, use an interactive risk-return chart.

- Trade guide signal: It provides an automatic buy/sell signal based on trend detection.

- Access to over 30,000 research studies covering all asset types.

Advantages:

- Set an alert for an entire demographic of scrips based on a certain criterion.

- Multi-asset watch list: You may make watchlists for several sectors such as stock, derivatives, commodities, and currencies.

- It includes a portfolio health check and review tool that allows you to compare and assess your portfolio as well as rearrange it.

Disadvantages:

- It is really large, and it requires a high system configuration to utilize without lagging.

#9 NSE NOW:

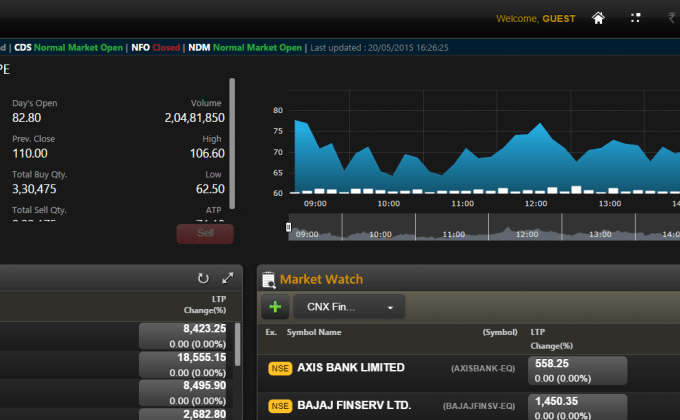

Unlike the other systems I mentioned before, which were created by individual stockbrokers, NOW (Neat on Web) is a web-based trading platform created by the NSE stock exchange.

There is no need to install any software, and it can be visited immediately from popular browsers such as Chrome, Firefox, or Internet Explorer.

It has a responsive design and hence automatically adjusts to the screen width of desktop, tablet, and mobile devices.

The best aspect is that because it is sponsored by the NSE, the NOW servers are closer to the NSE and hence prices are updated somewhat faster than the trading platforms of other brokers.

The strongest part is that because it is sponsored by the NSE, the NOW servers are closer to the NSE and hence prices are updated somewhat faster than the trading platforms of many other brokers.

Some notable brokers, such as Zerodha and Upstox, used to provide NSE NOW to their customers after obtaining an NSE license.

They have since terminated NOW after building their own platforms. However, a few brokers, such as Tradejini, continue to provide it to their clients.

The following are some of the most notable characteristics of NSE NOW:

- There are more than 80 technical indicators and 15 charts available.

- Create a market watch and monitor market behavior.

- Create online notification alerts based on the customer’s preferences.

- If your broker provides daily suggestions, NOW will present them in its interface.

- Less downtime and faster transaction execution.

Advantages:

- The login procedure is more secure with two-factor authentication (2FA).

- Both beginners and professionals may utilize it.

- When compared to other platforms, it is rather quick.

Disadvantages:

- The main worry is that it can only be utilized to trade on NSE exchanges. Because it is not possible to trade on the MCX and NCDEX, it cannot be used for commodity trading.

- The user experience (UX) is abysmal. It appears to be quite simple and crowded.

#10 Kotak Securities KEAT Pro X Trading Platform:

Kotak Securities’ KEAT Pro X is a desktop-based trading platform that allows you to trade stocks, derivatives, and currencies all on the same platform.

KEAT Pro X includes live market data streaming, the ability to establish customizable watchlists, and charting capabilities.

Kotak Securities KEAT Pro X is Available in two types.

Fastlane: When your business does not allow program installs, Fastlane is web-based software for KEAT ProX-like trading.

Xtralite: Xtralite is designed specifically for trading over sluggish internet connections. Even on limited bandwidth connections, Xtralite enables lightning-fast trading.

Advantages:

- Trade- in equities, futures, options, and currencies from a single platform.

- There are two variants to choose from.

Disadvantages:

- There are fewer charting tools.

Point to Note while choosing the best trading platform in India:

When selecting the best trading platform in India, there are several key points to consider. These include:

- Reliability and Security: Ensure that the trading platform is provided by a reputable and regulated brokerage firm to safeguard your investments and personal information.

- User-Friendly Interface: Look for a platform that offers an intuitive and easy-to-use interface, allowing for seamless navigation and efficient execution of trades.

- Real-Time Market Data: The platform should provide access to real-time market data, including stock prices, market news, and charts, to make informed trading decisions.

- Order Placement and Execution: Check if the platform offers a range of order types (market orders, limit orders, stop-loss orders, etc.) and reliable order execution with minimal delays.

- Charting and Technical Analysis Tools: Assess the availability of advanced charting tools, technical indicators, and drawing tools that assist in analyzing market trends and identifying trading opportunities.

- Research and Analysis: Look for platforms that offer comprehensive research reports, market analysis, and insights to support your investment decisions.

- Trading Instruments and Asset Classes: Ensure that the platform provides access to a wide range of trading instruments, including stocks, commodities, derivatives, mutual funds, etc., allowing for diversification in your investment portfolio.

- Customer Support: Consider the quality and availability of customer support, including prompt response to queries and technical assistance, to address any issues that may arise.

- Mobile Compatibility: If you prefer trading on the go, check if the platform offers a mobile trading app that is compatible with your smartphone or tablet.

- Cost and Fees: Evaluate the brokerage charges, transaction fees, and other costs associated with using the trading platform to ensure they align with your trading goals and budget.

- Reviews and Reputation: Read reviews and consider the platform’s reputation among other traders to gauge its performance and reliability.

By considering these points, you can make an informed decision when choosing the best trading platform in India that suits your trading style, preferences, and investment objectives.

What is the best trading platform for beginners in India?

For beginners in India, a user-friendly and intuitive trading platform is essential. Here are some of the best trading platforms suitable for beginners:

- Zerodha Kite: Zerodha Kite is widely regarded as one of the best trading platforms for beginners in India. It offers a clean and user-friendly interface with advanced charting tools, real-time market data, and easy order placement. Zerodha also provides educational resources and tutorials to help beginners learn about trading.

- Upstox Pro: Upstox Pro is another popular choice for beginners. It offers a simple and intuitive interface, real-time market data, customizable watchlists, and a range of order types. Upstox Pro provides educational materials and offers a demo mode for practice trading.

- 5Paisa Trader Terminal: 5Paisa Trader Terminal is known for its simplicity and ease of use, making it suitable for beginners. It provides real-time market data, advanced charting tools, and order placement capabilities. 5Paisa also offers educational resources and research reports to assist beginners in their trading journey.

- Angel Broking SpeedPro: Angel Broking SpeedPro is a beginner-friendly trading platform that offers a customizable interface, real-time market updates, and easy order placement. It provides useful features like heat maps and stock screeners to identify trading opportunities. Angel Broking offers educational resources and expert advisory services for beginners.

- Sharekhan Trade Tiger: Sharekhan Trade Tiger is a feature-rich trading platform suitable for beginners. It offers a user-friendly interface, advanced charting tools, real-time market data, and order placement options. Sharekhan provides educational materials and support to help beginners understand the basics of trading.

These trading platforms provide beginner-friendly features, educational resources, and a seamless trading experience. It is important for beginners to explore and compare these platforms based on their specific needs, preferences, and budget before choosing the one that suits them best.

Conclusion on Best Trading Platform in India:

In conclusion, there are several excellent trading platforms available in India, each offering its unique set of features and benefits. The best trading platform for you ultimately depends on your individual needs, preferences, and trading style. However, some platforms consistently receive positive feedback from traders and are regarded as top choices in the Indian market.

Zerodha Kite is widely recognized for its user-friendly interface, advanced charting tools, and real-time market data, making it an excellent option for beginners and experienced traders alike. Upstox Pro is another popular choice, known for its simplicity, customizable watchlists, and demo mode for practice trading.

Other notable platforms include 5Paisa Trader Terminal, which offers a simple interface and comprehensive research resources, and Angel Broking SpeedPro, which provides a customizable layout and features like heat maps and stock screeners.

Faqs on Best Trading Platforms in India

Which is the best trading company in India?

Determining the best trading company in India is subjective and can vary based on individual preferences and requirements. However, some of the top trading companies in India known for their reputation, reliability, and services include Zerodha, Upstox, Angel Broking, Sharekhan, and 5Paisa. It is advisable to thoroughly research and compare the offerings, trading platforms, brokerage fees, customer support, and other factors to determine the best trading company that aligns with your specific needs and trading goals.

Which platform is best for intraday trading?

When it comes to intraday trading, platforms with fast execution, real-time market data, and advanced charting tools are crucial. Some popular platforms known for their suitability for intraday trading include Zerodha Kite, Upstox Pro, Angel Broking SpeedPro, Sharekhan Trade Tiger, and 5Paisa Trader Terminal. These platforms offer features like quick order placement, real-time data updates, customizable charts, technical analysis tools, and low latency. It is recommended to explore and compare these platforms based on your specific intraday trading requirements before making a decision.

What is the safest trading platform in India?

Determining the safest trading platform in India involves considering factors such as regulatory compliance, security measures, and the reputation of the platform provider. While no platform can guarantee absolute safety, some platforms are known for their robust security measures and adherence to regulations. Zerodha, Upstox, Angel Broking, Sharekhan, and ICICI Direct are considered among the safest trading platforms in India, thanks to their established reputation, regulatory compliance, and implementation of stringent security protocols. It is important to conduct thorough research, review security features, and choose a platform provided by a reputable and regulated broker to enhance the safety of your trading activities.

What is the meaning of the Best trading platform?

The meaning of “best trading platform” refers to a trading software or online platform that is widely recognized and regarded as superior compared to other platforms. The best trading platform typically offers a combination of features such as a user-friendly interface, advanced charting tools, real-time market data, seamless trade execution, comprehensive research resources, and reliable customer support. It is subjective and can vary based on individual preferences, trading styles, and specific requirements. Ultimately, the best trading platform is one that meets the needs and preferences of the trader, providing a smooth and efficient trading experience.

What Are the details about the best trading platform in India?

The best trading platforms in India offer user-friendly interfaces, real-time market data, advanced charting tools, order execution capabilities, and comprehensive features. They are provided by reputable brokerage firms, ensuring reliability and security for traders. These platforms cater to both beginners and experienced traders, providing a seamless trading experience with access to a wide range of trading instruments and valuable research resources. The best trading platforms prioritize user convenience, customization options, and efficient trade execution to help traders make informed decisions and manage their investments effectively.

Please Read Our Related Articles