In this article, we are discussing everything you need to know about the 5Paisa review 2024, Check 5Paisa brokerage charges, margin, trading platform, Demat and trading account opening charges, branches, customer care contact, pros, cons, and more about 5Paisa.

5paisa Capital Ltd is a major online discount broker located in Mumbai. The broker began operations in March 2016 and, behind Zerodha, became India’s second-largest discount broker in December 2018. The notion behind the broker’s name, “5paisa,” is intriguing, since it implies that every paisa saved equals a paisa gained. 5paisa is a company that specializes in three areas: internet trading, insurance, and mutual funds. The brokerage company, which is a member of the BSE, NSE, NCDEX, and MCX, offers online trading in stock, derivatives, commodities, currencies, and initial public offerings. It also provides a variety of insurance options, such as term life, health insurance, and car insurance. Customers may also invest in both direct and regular mutual funds using the 5paisa mutual fund investment facility.

More About 5Paisa:

In March 2019, the broker became a registered DP with CDSL, and it now provides clients with a 5paisa Free Demat Account. To trade across all sectors, such as equities, F&O, commodities, currency, IPO, and so on, one may establish a 2-in-1 account with 5paisa, which includes a Demat and trading account. This is frequently referred to as an “All-in-1 investing account.” They can also acquire a free mutual fund account with a 2-in-1 account to invest in mutual funds. If you’re solely interested in mutual funds, though, there’s no need to establish a 5paisa trading account because you can simply open a free mutual fund account with the broker.

The broker’s amazing and rapid development may be attributed to its Flat brokerage model, which allows customers to trade online across all sectors for a flat charge of Rs. 20 per order under the Optimum plan. Furthermore, the broker provides the Basic, Power Investor, and Ultra Trader Packs, which have a cheaper flat price of Rs. 10 per transaction and a monthly fee of Rs. 499 and Rs. 999, respectively.

The discount broker provides the best-in-class trading platforms, such as a mobile trading app, an installable trading terminal, and a web-based trading platform. End-users will benefit from the world-class technology platform’s wealth of features that give simplicity, comfort, and flexibility.

5paisa has received numerous awards, including Best Digital Entrepreneur of the Year, Growing Brand Excellence in the BFSI Sector, Rising Company of the Year -2020, Top Broking Fintech Product, and recognition for the best use of mobile technology in the financial services industry. With 5paisa, you may also get a variety of value-added services including call and trade, research advice, Algo trading, and other services. Scroll down to see the full 5paisa review, which includes information on investment opportunities, brokerage fees, trading platforms, accounts, and more.

5Paisa Review: Advantages and Disadvantages:

5paisa.com, a full-service discount broker, offers online trading in equities, F&O, commodities, currency, and other categories for a flat charge of Rs. 20 per order.

What I Like (Pros):

A large and diverse product portfolio that includes equity, F&O, commodity, currency, IPO, MF, NFO, bonds, NCD, insurance, and so on.

The paperless/online account opening process allows you to begin trading in just a few minutes.

Access a 5paisa Free Demat Account to hold securities in dematerialized form.

Clients can keep their equity, derivatives, and mutual funds in one place with an All-in-One Investment Account.

To invest in mutual funds, the broker offers a free mutual fund account with no account opening fees.

Enjoy trading at an even reduced cost of Rs 10 per order with the Power Investor Pack and Ultra Trader Pack Prepaid membership plans.

- of Rs. 20 per order provide low-cost trading.

- Best-in-class trading platforms are available for free, including a mobile app, Trade Station Web, and Trade Station EXE.

- Swing Trader, Smallcase, Smart Investor, and Sensibull are some of the research tools available.

- Algo trading is available to construct a bespoke mutual fund portfolio based on the client’s specifications.

- Access free basic and technological research services.

- Margin Trading Facility is available with 5paisa.

- The 5Paisa App also provides additional financial perks such as insurance, gold, and loans.

- The broker’s 5paisa school is an endeavor to give stock market instruction to all levels of traders, whether novice, intermediate or expert.

What I Don’t Like (cons):

Call and trade service is a fee-based service.

The 3-in-1 account opening option is not accessible.

NRI trading is not permitted by the broker.

5Paisa Online Account Opening charges:

Opening a trading account costs Rs 300. (Rs 500 Cashback as Brokerage)

Trading Account AMC: Free

Demat Account Opening Charges: Free

AMC for Demat Accounts: Holdings under 50K – Free, holdings between 50K and 2L – Rs 8L

5Paisa Brokerage Plan:

| Criteria | Basic Pack | Power Investor Pack | UltraTrader Pack |

|---|---|---|---|

| Account Opening Fee | Free | Free | Free |

| Brokerage | Rs 20 per order | Rs 10 per order | Rs 10 per order |

| Call & Trade | Rs 100 per call | Rs 100 per call | Free |

| Demat AMC | Rs 25 per month | Rs 25 per month | Rs 25 per month |

| DP Transaction Charges | Rs 12.5 per scrip (sell-side) | Free | Free |

| Fund Transfer Charges | Net Banking: Rs 10, UPI: Free, and IMPS: Free | Net Banking: Rs 10, UPI: Free, and IMPS: Free | Free |

| Direct MF Investment Charges | Rs 20 | Free | Free |

| Research Advisory | Not Available | Free | Free |

| Free Trades | NA | NA | Free 100 trades per month maximum of Rs 1000 |

| Dedicated Customer Support | NA | Free | Available |

5Paisa Brokerage Charges:

5paisa offers very competitive brokerages, with a flat fee of Rs. 20 across all sectors, which is comparable to other cheap brokerage firms.

| Segment | Brokerage Fee |

|---|---|

| Equity Intra-day | Flat fee at Rs 20 per order |

| Equity Delivery | Flat fee at Rs 20 per order |

| Equity Futures | Flat fee at Rs 20 per order |

| Equity Options | Flat fee at Rs 20 per order |

| Commodity Futures | Flat fee at Rs 20 per order |

| Commodity Options | Flat fee at Rs 20 per order |

| Currency Futures | Flat fee at Rs 20 per order |

| Currency Options | Flat fee at Rs 20 per order |

5Paisa Margin:

- 5paisa exposure for intraday trading – Upto 20x for stocks on which F&O trading is allowed.

- 5paisa exposure for delivery trading – Upto 3.5x for delivery trading.

- 5paisa exposure for trading in equity and index futures – 3x margin for futures trades (Selling only).

- 5paisa margin for Options – 3x margin for Options Trades(Selling only).

Open a Demat and Trading Account with 5Paisa:

The All-in-One Investment Portfolio and the Free Mutual Fund Account are the two major types of accounts offered by 5paisa discount stock brokerage firms. Both of these accounts allow users to trade a variety of financial goods in order to meet their investing needs.

5paisa All-in-one Investment Account:

The all-in-one account, as the name implies, is a platform that combines three accounts: a 5paisa Demat Account, a 5paisa Trading Account, and a 5paisa Mutual Fund Account. People may trade across all sectors by creating an all-in-one account with 5paisa, including equity, commodities, derivatives, currency, IPO, MF, bonds, insurance, and so on. Personal loans and technology-driven research and advising tools are also available. Let’s take a closer look at each of the three accounts.

5paisa Demat Account:

The broker provides a Demat account opening service as a CDSL DP. To receive securities in an electronic or dematerialized version, one can create a Demat account with 5paisa online or offline. The broker provides a no-cost Demat account with no account opening fees.

5paisa Trading Account:

Using a Trading Account, you may buy and sell stocks, derivatives, commodities, currencies, and other financial instruments. The main reason to create a 5paisa Trading Account is to benefit from inexpensive brokerage and a single order cost of Rs. 20 across all segments. Because your trading and Demat accounts are connected, you may trade without interruption. You may establish a 5paisa trading account online in a matter of minutes and start trading right away.

5paisa Mutual Fund Account:

Customers who create a 2-in-1 or all-in-one account with 5paisa will receive a complimentary mutual fund account. The broker, which has a connection with more than 23 asset management companies, offers a wide range of mutual fund schemes in both direct and regular plans. People may also look at expert-selected funds in many categories, as well as top-performing funds, and so on.

Pros:

- Trade-in stock, futures and options, commodities, currencies, IPOs, mutual funds, and so on.

- An all-in-one account is a platform that allows you to keep all of your stocks, mutual funds, and other assets in one location.

- There is no need to create a separate commodities trading account. You may open a free mutual fund account with no additional fees.

- Across all sectors, trade at a flat brokerage.

Cons:

- online broker exclusively caters to Indian citizens, which implies that non-resident Indians are unable to establish an account with 5paisa.

5paisa Free Mutual Fund Account:

If you just invest in mutual funds and do not trade in stocks, options, commodities, currencies, IPOs, or other products, it is preferable to create a 5paisa Mutual Fund Account to avoid Demat and trading account fees. You may create a NO CHARGE Mutual Fund Account with the broker and invest in direct and regular schemes via SIP or lumpsum. Direct plans have a fixed price of Rs. 10 for each order, whilst conventional programs are free to invest in. Auto Investor services are also available from the broker to assist them in creating a personalized MF portfolio based on their goals, risk tolerance capacity, and duration.

Benefits:

- Create a free Mutual funds account with no fees.

- Direct and regular plans are both available.

- You may start, stop, or change your SIP investment at any time.

- Invest in direct programs for a one-time fee of Rs. 10 per order.

- There is no commission to pay. Regular plans are an investment.

- To preserve your MF holdings, get a free lifetime Demat account.

- Choose between SIP and lumpsum payments.

- Specify your objective, investment term, and risk to create a customized portfolio.

Drawback:

- Because there is no provisioning for NRIs, they are unable to invest in mutual funds with 5paisa.

5Paisa Trading Software (5Paisa Trading Platforms):

5paisa provides a full suite of in-house trading platforms, such as the 5paisa mobile app, web platform, and trading terminal or technology for online trading. Each of the three trading platforms is available to users for free. The following is a quick explanation of each of the platforms supplied by the broker.

5paisa Mobile Trading Application:

The 5paisa Mobile app is one of the strongest in the market, which is why it was awarded the “Best Mobile Trading App” award in November 2018. You could use the 5paisa application anywhere in the world to trade and access the premium features that made it the largest trading platform for investment in all products. You can use the 5paisa app for simple and convenient user interfaces, multi-asset watchlists, Auto-investors, retail quotes, strong charting, rapid trading, thematic investment, etc. You may get a 5paisa app for your Android or iOS smartphone from the Google Play Store or the App Store.

5paisa Trade Station Web:

The web-based trading platform on 5paisa.com is known as Trade Station Web. Users may access the 5paisa online platform using any supported browser, including Firefox, Chrome, Safari, and Internet Explorer. 5paisa’s Trade Station allows you to trade stocks, futures, options, commodities, currencies, IPOs, mutual funds, and more. Many features are included in the lightning Trade Station Web, including a user-friendly interface, market watch, market watchlist with sparklines, a complete dashboard, 20 years of statistical information, technical charts & indicators, market analytics, and more.

5paisa Trade Station EXE:

The desktop trading program, often known as the 5paisa trading terminal, is Trade Station EXE. Multiple order placement, sophisticated watchlist, advanced charting & tools, portfolio tracker, quick & reliable trade execution, keyboard shortcuts, order slicing, price alerts & notification, and more capabilities may be unlocked by installing the software on your desktop. The 5paisa trading terminal, which can be downloaded from the broker’s website, is quite beneficial for advanced traders. The main disadvantage is that the terminal’s iOS version is not yet ready, thus Mac and iOS users will be unable to use it.

5paisa Other Trading Tools:

5paisa provides a number of research tools, which are detailed below:

Smart Investor: The broker, in collaboration with Marketsmith India, provides the highest quality of stocks that have been thoroughly studied by the research team, allowing customers to construct a fantastic portfolio of chosen equities.

Algo Trading: As the name implies, it is an automated trading platform that analyses market data using computer algorithms based on many pre-specified parameters. Clients may also utilize the platform to create their own strategy, test it, and submit it to the exchange for approval.

Swing Trader: This approach provides a fundamental and technical examination of numerous stocks to assist traders in picking the best stock for short-term trading opportunities.

Smallcase: A smallcase is a diversified portfolio of well-researched companies that are linked to a certain topic, idea, or approach. Customers can invest in certain equities depending on a specific subject they choose based on their market view.

Sensibull: It is an options trading technology platform that allows users to study options data using various tools such as an Open Interest analyzer, screeners, event calendars, options Greeks, simulated trading, and so on. As a result, it’s a one-stop shop for easy options trading with effective methods.

5Paisa Products & Services:

The following is a list of the 5Paisa brokerage house’s products and services.

Products:

The following is a list of products that are available.

- Equity

- Derivatives

- Mutual Funds

- Insurance

- SIP

- Currency

Services:

Many services are available:

- Demat Account

- Trading Account

- Intraday Services

- Robo Advisory

- IPO Services

- Exposure up to 6x

5Paisa Customer Ratings & Review 2024:

| Criteria | Ratings |

|---|---|

| Research & Advisory | 9.20/ 10 |

| Product & Services | 9.05 / 10 |

| Trading Platform | 9.30 / 10 |

| Booking Experience | 9.25/ 10 |

| Brokerage Charges & Fees | 8.90 / 10 |

| Overall Rating | 9.16/10 |

| Customer Rating | ★★★★★ |

5Paisa Complaint:

| Exchange | Financial Year | Number of Clients | Complaints |

|---|---|---|---|

| NSE | 2021-22 | 1,002,020 | 110 |

| NSE | 2020-21 | 870,405 | 612 |

| BSE | 2020-21 | 70,969 | 7 |

| NSE | 2019-20 | 434,036 | 199 |

| BSE | 2019-20 | 70,767 | 18 |

| NSE | 2018-19 | 101,043 | 96 |

| BSE | 2018-19 | 24,382 | 14 |

| NSE | 2017-18 | 36,034 | 41 |

| BSE | 2017-18 | 19,545 | 28 |

Conclusion:

5paisa is a fully digital broker that offers equities, derivatives, commodities, and currency trading, as well as IPOs, mutual funds, and other financial products. The online discount broker offers customers low-cost trading services by offering trading across multiple sectors for a fixed brokerage fee. It is also the first online broker to provide consumers with Algo trading and Robo advising services.

It also offers a world-class trading experience with its technology-driven mobile application, web trading platform, and trading terminal. In fact, 5paisa’s free mutual fund account, unique research tools, advisory services, and other features entice a huge number of people to establish an account and trade without paper. 5paisa is one of the finest alternatives if you’re seeking the cheapest discount brokerage to trade in numerous financial goods and services. However, the broker’s main drawback is that it does not support NRI trading.

More Related Articles About Discount Brokers Please Read.

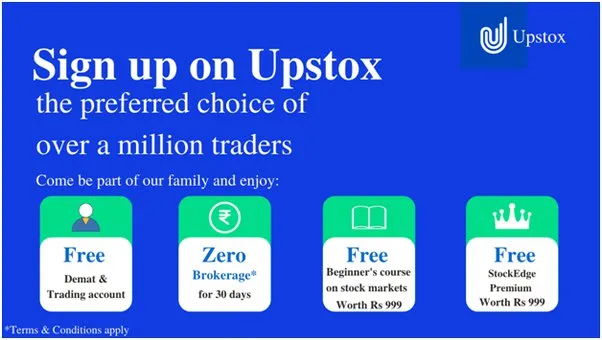

| Zerodha Review | Upstox Review |

| 5Paisa Review | SAS Online Review |

| SAMCO Review | Angel One Review |

| GROWW Review | Trade Smart Review |

| Tradejini Review | Wisdom Capital |