How to open a Demat account online: Many people are fascinated by news about the rise or collapse of the stock market. Opening a Demat Account is the first step toward getting started.

A Demat Account is a type of account that allows you to keep stock market shares as well as other assets such as IPOs, bonds, government securities, mutual fund units, and exchange-traded fund units (ETFs). A Demat Account ensures the protection of all such financial investments while also making their administration and maintenance more convenient.

Our Top Pick Stock Broker for Demat Account in India 2024

What is the Procedure for Opening a Demat Account?

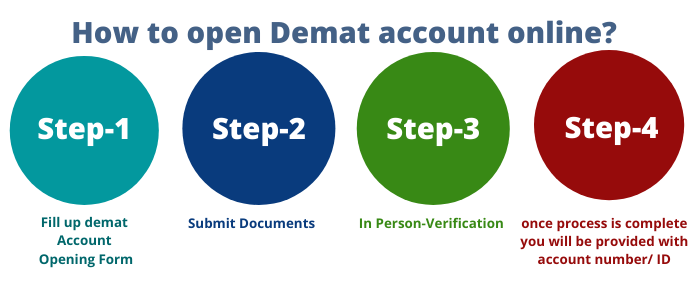

The following is the procedure for opening a Demat account:

# Step 1: Decide where you want to open your Demat account first. Then select a DP with which to create a Demat and trading account. Many banking firms and brokerage firms provide this service.

# Step 2: Fill out the account opening form and send it in with copies of all required papers and a passport-size photograph.

# Step 3: Original documents should be kept on hand for verification.

# Step 4: A copy of the terms and conditions agreement will be sent to you. Take a look at it.

# Step 5: A representative from DP will contact you to confirm the information you’ve provided.

#step6: If your application is approved, you’ll receive a Demat account number as well as a client ID that you may use to access your account online.

Some account opening fees, such as the yearly maintenance cost and the transaction fee, must be paid (on a monthly basis). The cost varies from one Depository Participant to the next. Some DPs levy a flat fee per transaction, while others levy a percentage of the overall transaction amount. Converting shares from physical to electronic versions, or vice versa is also charged by DPs.

There is no minimum quantity of securities required to keep your account active.

Documents Required for Opening a Demat Account:

You must send your ID evidence, address proof, and a passport-sized photo together with an opening form when creating a Demat account online. You must supply photocopies of the needed papers. You should also maintain originals on hand for verification. The following is a thorough list of papers that are recognized as evidence for creating a Demat account online.

Identity Documentation:

- Voter ID.

- Electricity Bill.

- Pan Card.

- It returns.

- Passport.

- Telephone Bill.

- Bank Attestation.

Any other picture ID card issued by the state or federal government and other departments, regulatory or statutory agencies, scheduled commercial banks, PSUs (public sector undertakings), public financial institutions, or professional organizations such as ICSI, ICAI, and the bar council, among others.

Proof of Address:

- Passport.

- Ration Card.

- Driving License.

- Voter ID.

- Bank Statement.

- Bank Passbook.

- Electricity Bill.

- Telephone Bill.

- Agreement for Sale.

- Self-Declaration by Supreme Court or High Court Judges.

State or central government agencies, regulatory or statutory authorities, scheduled commercial banks, PSUs (public sector undertakings), public financial institutions, or professional organizations such as ICSI, ICAI, bar council, and others may issue a document or ID card.

How to Select the Best Demat Account for Trading?

To buy and store financial securities, you’ll need a Best Demat account. It keeps track of all of your investments in an electronic format. A Demat account is maintained by two depositories in India. The National Securities Depository Limited (NSDL) and the Central Depository Services Limited (CDSL) are their names (CDSL).

Choosing a depository is the first step in setting up a Demat account:

Investors have the option of choosing between the NSDL and the CDSL. Following the selection of a depository, the investor must select a Demat account. In contrast to depositories, several financial organizations provide Demat accounts. Investors are frequently perplexed as to which option to select. As a result, we’ve compiled a list of considerations to make when selecting a Demat account.

The ease with which you may open a Demat account:

The Securities and Exchange Board of India (SEBI) has laid out a step-by-step method for creating a Demat account. All SEBI-mandated norms and regulations must be followed by Demat account providers. They may, however, make the account opening procedure go more smoothly by allowing investors to complete their e-KYC online. Any type of verification may be done both online and offline. As a result, look for a bank or financial institution that provides a Demat account with simple and straightforward procedures. Take into consideration the time it took to open the Demat account. It shouldn’t take more than two days for internet verifications, and three to five days for offline verifications.

Expenses and maintenance charges:

Account opening fees, account maintenance fees, and trading fees are all included in the cost of a Demat account. Some brokers even demand extra fees for extra services. For example, if an investor requests a tangible copy of his or her Demat account holdings, the broker will charge a fee. As a result, investors should be aware of all the fees associated with a Demat account. They should also look for a broker that has minimal account maintenance and trading fees.

Trading Software interface:

A Demat account and trading account are linked to the bank account to facilitate trading and investing online. Hence it is a seamless interface between the bank and the Demat account. The brokers should be able to provide multiple ways of accessing a Demat account, for example, through a website or an app. Some banks also offer Demat and trading accounts, called the 3 in-1 accounts and there are also 2 in 1 account. These accounts help facilitate the transfer of money from the bank account to the trading account and vice versa smoothly. Hence choose a Demat account that makes online trading seamless and effortless.

Data Analytics and Reports:

For traders, a Demat account provides data on profitability, diversification, valuation, and a clear call to action. These reports will assist you in making critical trading and investing decisions. As a result, an investor or trader should select a Demat account that has all of these features at no extra charge.

Additional services offered:

Demat account providers offer extra services to their customers to distinguish themselves from other brokers. Quick customer service and advice concerning the purchase and selling of securities, among other things, have become more significant in terms of customer service leadership. As a result, before choosing a broker, investors should evaluate brokers based on how accessible they are in times of need and the extra services they provide.

Can I open a Demat account without opening a trading account?

The Demat account is intended to keep your investments in shares, bonds, ETFs, etc. If you want to purchase and sell shares or futures and options, you need a trading account. Brokers usually open a trading-cum-Demat account since both of these accounts are linked. There is hence no requirement for both a Demat and a trading account to start with the best stockbroker.

For example, if you have requested an IPO and only wish to maintain the shares, then Demat would be enough. You would, however, need a required trading account if you want to sell those shares in the stock market.

How long does it take to open a Demat account?

In general, the opening of a Demat account will take around 48 and 72 hours. The establishment of Demat accounts would be delayed by any inconsistencies in papers or formats.

Also, Read Demat Account Related Article:

- Best Demat Accounts for IPO Investment

- Best Banking Brokers for Demat Accounts

- Top Picks: Best 3-in-1 Demat Accounts for Seamless Investing in India

- Best Platforms Offering Free Demat Accounts in India

- Best Demat Accounts for Long-Term Investment in India

- Top 4 Best Demat Account For NRI

- Best Demat Accounts for Mutual Funds in India

- Best Demat Accounts for Intraday Trading

- Best Demat Accounts for Small Investors

- Best Trading Accounts in India | List of Top 6 Trading Accounts

- Compare Top Share Brokers

- Zero Brokerage Trading Accounts in India

- Best Trading Platforms for Beginners in India

- Best Discount Brokers for Beginners in India

- Best Stock Brokers for Beginners in India

- Best Demat Accounts for Beginners In India

- Best Demat Accounts in India: Simplify Your Investment Journey