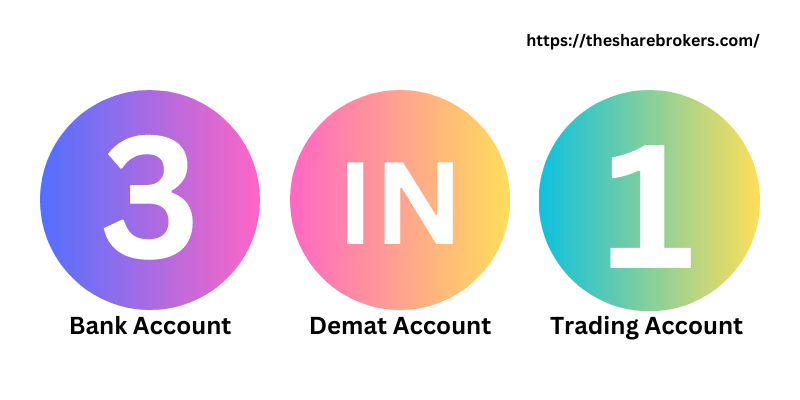

In India, a Demat account is a necessary tool for investing in stocks and other securities. A Demat account allows investors to hold securities in an electronic form, eliminating the need for physical share certificates. A 3-in-1 Demat account refers to a combination of a Demat account, trading account, and bank account, all linked together. This combination is convenient for investors as it allows them to manage their finances and investments from a single platform. In this article, we will discuss the best 3-in-1 Demat accounts in India.

A 3-in-1 demat account is a combination of a trading account, a demat account, and a bank account, all integrated into a single account. This type of account is offered by select brokers in India and provides a seamless experience for trading and investing in the stock market. In this article, we will discuss the best 3-in-1 demat accounts available in India.

There are three components of the 3-in-1 Accounts are:

- Savings Account: The savings account is linked to your Axis Bank 3-in-1 account, and you can use it for regular banking activities such as deposits, withdrawals, and fund transfers.

- Demat Account: The demat account is used for holding your investments in electronic form. It eliminates the need for physical share certificates, making it easier to manage your investments. The demat account is mandatory for trading in the Indian stock market.

- Trading Account: The trading account is used for buying and selling securities in the stock market. You can trade in various financial instruments such as equities, derivatives, currency, and commodities using your Axis Direct 3-in-1 Account.

List of Top 5 Best 3-in-1 Demat Accounts in India 2024

Over all Ratings | Account Annual Maintenance Charges | ||

1. ICICI Direct (Full-Service Broker) | Free | Rs. 700 | |

2. HDFC Securities (Full-Service Broker) | Free | Rs. 750 | |

3. Kotak Securities (Full-Service Broker) | Free | Rs 600 | |

4. SBICap Securities | Rs 850 | Free | |

5. Axis Direct (Full-Service Broker) | Free | Rs 750 |

1. ICICI Direct 3-in-1 Account:

ICICI Direct is a leading brokerage firm in India that offers a 3-in-1 account. The account is a combination of a trading account, a demat account, and a savings bank account. The savings account is maintained with ICICI Bank, which is one of the largest banks in India. The account offers a range of investment options, including stocks, mutual funds, bonds, and IPOs. The account also provides access to research reports and market analysis, as well as a range of trading tools and platforms.

ICICI Direct charges a fee for account opening and maintenance, as well as a brokerage fee for trades. However, the fees are competitive compared to other brokerage firms in India. The account opening process is also relatively easy, and the account can be opened online or at an ICICI Bank branch.

ICICI Direct Demat Account Fees & Charges:

| Types of Charges | Charges |

| Demat account opening charges | Nil |

| Demat account annual maintenance charges | Rs. 700 (waived for ICICIdirect customers for the first year) Rs. 300 for ICICIdirect Neo customers from first year onwards |

| Demat account transaction charges | Buy – Nil for transactions done at ICICIdirect platformSell – 0.04% of the value of securities (Minimum Rs. 30 and maximum Rs. 25,000) |

| Rejection of failure of transfer instruction for delivery (TFID) | Rs. 30 |

| Reconversion of mutual fund units | Rs. 25 per instruction |

| Dematerialization of share certificate | Rs. 50 for each request |

| Rematerialization of share certificate | Rs. 25 for every hundred securities subject to a maximum fee of Rs. 3 lakhs or a flat fee of Rs. 25 per certificate (whichever is higher) |

| Closure of Demat account | Nil |

2. HDFC Securities 3-in-1 Account:

HDFC Securities is another popular brokerage firm in India that offers a 3-in-1 account. The account is a combination of a trading account, a demat account, and a savings bank account. The savings account is maintained with HDFC Bank, which is one of the largest private banks in India. The account offers a range of investment options, including stocks, mutual funds, bonds, and IPOs. The account also provides access to research reports and market analysis, as well as a range of trading tools and platforms.

HDFC Securities charges a fee for account opening and maintenance, as well as a brokerage fee for trades. The fees are competitive compared to other brokerage firms in India. The account opening process is also relatively easy, and the account can be opened online or at an HDFC Bank branch.

HDFC Securities Demat Account Fees & Charges:

| Demat Account Offer | Annual Mainten[ance Charge (from 2nd Year onwards) | Special pricing as per Managed Program Debit/ Pledge Txn Charge | Standard Charges Debit/Pledge Txn | You Save | |

| Infiniti/Imperia | Nil | Min. Rs. 30/- or 0.03% of the value of the transaction (Max Rs. 4,999/-) | Min. Rs. 30/- or 0.04% of the value of the transaction (Max Rs. 4,999/-) | 100% | |

| Preferred | Zero (in case of 1 txn p.a.) OR Rs.300/- | Min. Rs. 30/- or 0.03% of the value of the transaction (Max Rs. 4,999/-) | Min. Rs. 30/- or 0.04% of the value of the transaction (Max Rs. 4,999/-) | 100% to 25% | |

| Classic | Rs. 250/- (in case of 1 txn p.a.) OR Rs.500/- | – | Min. Rs. 30/- or 0.04% of the value of the transaction (Max Rs. 4,999/-) | 66% to 33% | |

| Prime | Rs. 700/- | – | Min. Rs. 30/- or 0.04% of the value of the transaction (Max Rs. 4,999/-) | 7% | |

| Standard | Rs. 750/- | – | Min. Rs. 30/- or 0.04% of the value of the transaction (Max Rs. 4,999/-) | NA | |

| * Demat AMC is waived of for the 1st year | |||||

3. Kotak Securities 3-in-1 Account:

Kotak Securities is a well-known brokerage firm in India that offers a 3-in-1 account. The account is a combination of a trading account, a demat account, and a savings bank account. The savings account is maintained with Kotak Mahindra Bank, which is one of the largest private banks in India. The account offers a range of investment options, including stocks, mutual funds, bonds, and IPOs. The account also provides access to research reports and market analysis, as well as a range of trading tools and platforms.

Kotak Securities charges a fee for account opening and maintenance, as well as a brokerage fee for trades. The fees are competitive compared to other brokerage firms in India. The account opening process is also relatively easy, and the account can be opened online or at a Kotak Mahindra Bank branch.

Kotak Securities Demat Account Fees & Charges:

| Sr | Account Head | Rate | Minimum Payable |

| 1 | Dematerialisation | ₹50/- per request and ₹3/- per Certificate | – |

| 2 | Rematerialisation | ₹10/- for 100 securities (shares, bonds, mutual fund units etc) | ₹15/- |

| 3 | Market / Off-Market Transactions (Sell) | 0.04% of the value of securities (Plus NSDL Charges) | ₹27/- (Plus NSDL charges as applicable) |

| 4 | Regular Account Maintenance Charges | • Holding value of securities < = ₹10,000 : No AMC (basis maximum value during the month) • Holding value of securities > ₹10,000 Resident ₹65 p.m. for upto 10 debit transactions ₹50 p.m. for 11 to 30 debit transactions ₹35 p.m. for more than 30 debit transactions NRI – ₹75 p.m. | – |

| BSDA AMC | As per SEBI (Refer Note below) | ||

| 5 | Pledge Charges | 0.05% of the value of securities | ₹30/- |

| 6 | Invocations of Pledge | 0.04% of the value of securities | ₹30/- |

| 7 | Pledge Charges (For margin purpose) a. Request b. Invocation c. Release (Un-pledge) d. Re-Pledge | ₹20 per ISIN ₹20 per ISIN ₹20 per ISIN FREE | – – – – |

| 8 | DIS Re – Issuance | ₹99/- per DIS Booklet | – |

| 9 | Charges for CAS | NSDL charges (Refer Note below) | – |

4. SBI Cap securities 3-in-1 Account:

The SBI Cap 3-in-1 Account is a financial product offered by the State Bank of India (SBI) that combines three accounts into one: a savings bank account, a demat account, and a trading account. This account allows customers to invest in a wide range of financial instruments, including equities, mutual funds, bonds, and other securities.

The savings account is used to hold funds that can be used to invest in the stock market through the trading account. The demat account is used to hold the shares and other securities that are bought and sold through the trading account. The trading account is used to buy and sell securities in the stock market.

SBI Cap securities Demat Account Opening Fees & Charges:

| Transaction | Fee |

|---|---|

| Trading Account Opening Charges (One Time) | Rs 850 |

| Trading Annual Maintenance Charges AMC (Yearly Fee) | Rs 0 |

| Demat Account Opening Charges (One Time) | Rs 0 |

| Demat Account Annual Maintenance Charges AMC (Yearly Fee) | Rs 350 |

- SBI Securities Demat Charges

| Transaction | Charges |

|---|---|

| Demat Account Opening Charges | Rs 850 |

| Transaction Charges (Buy) | |

| Transaction Charges (Sell) | Through POA – 0.01% of the transaction value (Minimum of Rs 21 and Maximum of Rs 300) per ISINThrough DIS – 0.04% of the transaction value (Minimum of Rs 30) per ISIN |

| Annual Maintenance Charges (AMC) | Individual Account: Rs 750 (Rs 500 for e-statement) |

| Demat + Courier charges | Rs 5 per cert + Rs 35 courier charges per request |

| Remat | Rs 35 Per Request + CDSL Charges i.e. Rs 10 per 100 securities or part quantity |

| Pledge Creation | If SSL / SBI is the counter party:Â 0.02% of Value or Min Rs 25 whichever is higher + CDSL chargesIf SSL / SBI is not the counter party:Â 0.04 % of the transaction value subject to a Minimum of Rs 50 per ISIN instruction + CDSL Charges |

| Pledge Creation Confirmation | If SSL / SBI is the counter party:Â 0.02% of Value or Min Rs 25 whichever is higher + CDSL chargesIf SSL / SBI is not the counter party:Â 0.04 % of the transaction value subject to a Minimum of Rs 50 per ISIN instruction + CDSL Charges |

| Pledge Invocation | If SSL / SBI is the counter party:Â 0.02% of Value or Min Rs 25 whichever is higher + CDSL chargesIf SSL / SBI is not the counter party:Â 0.04 % of the transaction value subject to a Minimum of Rs 50 per ISIN instruction + CDSL Charges |

| Failed Transactions | Rs 10 per failed instruction. |

5. Axis Direct 3-in-1 Account:

Axis Direct is a subsidiary of Axis Bank, which offers a 3-in-1 Account that integrates your bank account, demat account, and trading account. This account allows you to invest in a variety of financial instruments such as stocks, mutual funds, IPOs, and bonds, among others.

Axis Direct Demat Account Fees & Charges:

| DESCRIPTION OF CHARGES | REGULAR DEMAT ACCOUNT | BASIC SERVICES DEMAT ACCOUNT(BSDA) | BASIS OF RECOVERY |

|---|---|---|---|

| Account Opening Charge | Nil | Nil | NA |

| Account Closing Charge | Nil | Nil | NA |

| Annual Maintenance Charge** | Axis Bank Customer First Year: NIL Second Year Onwards: Rs. 750/- Non-Axis Bank Customer First Year: Rs. 350/- Second Year Onwards: Rs. 750/- | For Debt Securities Holding Value: Upto Rs. 1,00,000 : NILRs. 1,00,001 to Rs. 200,000 : Rs. 100/-Above Rs. 200,000 : Tariff for regular accounts will be applicable For other than Debt Securities Holding Value: Upto Rs. 50,000 : NILRs. 50,001 to Rs. 200,000 : Rs. 100/-Above Rs. 200,000 : Tariff for regular accounts will be applicable | AMC for existing Demat Accounts to be recovered up-front every year. New Accounts would be charged on pro-rata basis from the Next Day of Account Opening. |

| Demat Charges | Rs. 5/- per certificate or Rs.50/- per request, whichever is higher | Same as per regular account | To be recovered through monthly bill |

| Remat Charges | Rs.20/- for every 100 securities or part thereof or Rs.50/- per request, whichever is higher. | Same as per regular account | To be recovered through monthly bill |

| Courier Charges perDemat / Remat/ Demat Rejection | Rs.100/- | Rs.100/- | To be recovered through monthly bill |

| Ad-hoc Statement | Rs.100/- per Statement | Same as per regular account | To be recovered upfront. |

| DIS Booklet Charge | First DIS Book (10 Leaves): NIL Additional Booklet(10 Leaves):Rs.100/- | Rs. 200/- per Booklet from DIS reissuance | To be recovered through monthly bill |

| Account Modification Charges | Modification in CML:Rs.25/-per request KRA Upload/ Download: Rs. 50/- | Rs. 100/- | To be recovered through monthly bill |

| Credit Transactions | Nil | Nil | NA |

| Debit Transactions (Other than Debt Securities) | 0.04% of the value of the transaction or Rs.25/- (per Instruction) whichever is higher. | 0.06% of the value of the transaction or Rs.50/- (per Instruction) whichever is higher. | To be recovered through monthly bill |

| Debit Transactions (Debt Securities) | 0.01% of the value of the transaction subject to minimum of Rs.50/- & maximum of Rs.500/- per transaction | Same as per regular account | To be recovered through monthly bill |

| Failed / Rejected Instruction | Rs.10/- per Instruction | Same as per regular account | To be recovered through monthly bill |

| Creation | Normal : 0.04% of the value of the transaction or Rs. 50/- (per instruction) whichever is higherMargin Pledge : 0.03% of the value of the transaction or Rs. 25/- (per instruction) whichever is higherMargin Trading Funding : Rs. 25/- per instruction | Normal : 0.06% of the value of the transaction or Rs. 50/- (per instruction) whichever is higherMargin Pledge : 0.03% of the value of the transaction or Rs. 25/- (per instruction) whichever is higherMargin Trading Funding : Rs. 25/- per instruction | To be recovered through monthly bill |

| Closure / Invocation | Normal : 0.04% of the value of the transaction or Rs. 50/- (per instruction) whichever is higherMargin Pledge :NILMargin Trading Funding :NIL | Normal : 0.06% of the value of the transaction or Rs. 50/- (per instruction) whichever is higherMargin Pledge :NILMargin Trading Funding :NIL | To be recovered through monthly bill |

| NDU (Non-Disposal Undertaking) SERVICES | |||

| Creation/ Closure / Invocation | 0.02% of the value of the transaction or Rs. 50/- (per instruction) whichever is higher | Same as per regular account | To be recovered through monthly bill |

| SPEED-e (Applicable for NSDL) | |||

| SPEED-e Annual Maintenance charges | NSDL Charges (at actual) | NSDL Charges (at actual) | To be recovered through monthly bill |

| SPEED-e Debit Transactions | Rs.25/- per Instruction | 0.06% of the value of the transaction or Rs.50/- (per Instruction) whichever is higher. | To be recovered through monthly bill |

| Freezing Instruction on SPEED-e | Rs. 125/- per Instruction | Same as per regular account | To be recovered through monthly bill |

| Quarterly(Physical) Statement | Rs. 50/- | Rs.25/- per statement (applicable from issuance of 3rd quarterly statement in a year) | To be recovered through monthly bill |

| MUTUAL FUND | |||

| Debit Transactions | Rs.25/- per Instruction | Rs.50/- per Instruction | To be recovered through monthly bill |

| Conversion of MF units represented by SOA into dematerialized form | NIL | NIL | To be recovered through monthly bill |

| Conversion of MF units represented by SOA into dematerialized form | Rs.50/- per request as courier charges for mutual fund units | Same as per regular account | To be recovered through monthly bill |

| Reconversion of MF units into SOA | Rs.50/- per Instruction | Same as per regular account | To be recovered through monthly bill |

| Redemption of MF units through Participants | Rs.25/- per Instruction | Same as per regular account | To be recovered through monthly bill |

| Pledge Creation / Closure / Invocation | Rs.25/- per Instruction | Same as per regular account | To be recovered through monthly bill |

BROKERAGE PLANs

| SR. NO. | PLAN | PLAN CHARGES | DELIVERY | INTRADAY & FUTURES | OPTIONS | NOTES |

|---|---|---|---|---|---|---|

| 1. | Standard | Rs. 499 | 0.50% | 0.05% | Rs. 10 per order through online platforms and Rs 10 per Lot for assisted trades | 1. Applicable for RI customers only 2. Min brokerage of Rs. 25/- per executed order or 2.5% whichever is less |

| 2. | Now or Never | Rs. 5555 | 0.25% (post CDT) | 0.03% | 1. Applicable for RI customers only 2. Min brokerage of Rs. 25/- per executed order or 2.5% whichever is less 3. Plan Validity : 10 Years Plan Code :NN5555 4. One time Account setup charge of Rs. 5555# 5. Complimentary Delivery Turnover of Rs. 12 lakhs (valid for 12 months) 6. Delivery Brokerage worth Rs. 6000/- | |

| 3. | Investment Plus | Rs. 1500 | 0.5%(post CDT) | 0.50% | 1. Applicable for RI customers only 2. Min brokerage of Rs. 25/- per executed order or 2.5% whichever is less 3. Complimentary Delivery Turnover of Rs. 3 lakhs 4. Effective Waiver of Axis Direct Account Opening charge |

Factors to be considered while choosing a 3-in-1 demat account:

When choosing a 3-in-1 demat account, there are several factors that you should consider. Here are some of the important factors that you should keep in mind:

- Brokerage Fees: One of the most important factors to consider while choosing a 3-in-1 demat account is the brokerage fees charged by the broker. Different brokers may have different fees for account opening, maintenance, and brokerage charges for trades. Make sure to compare the fees charged by different brokers and choose the one that offers the most competitive rates.

- Trading Platform: The trading platform is the software used to buy and sell stocks and other securities. It is important to choose a broker that offers a user-friendly and reliable trading platform. The platform should have all the necessary features, such as real-time market data, research reports, technical analysis tools, and easy order placement.

- Investment Options: Another important factor to consider is the range of investment options offered by the broker. A good broker should offer a wide range of investment options, such as stocks, bonds, mutual funds, ETFs, IPOs, and derivatives. This will give you more flexibility and diversification options for your portfolio.

- Customer Support: The quality of customer support is another important factor to consider. The broker should have a dedicated customer support team that can assist you with any queries or issues you may have. They should be available through multiple channels, such as phone, email, and chat.

- Security: The security of your investments and personal information is also a critical factor to consider. The broker should have robust security measures in place to protect your account from fraud and cyber threats. This may include two-factor authentication, encryption, and regular security audits.

- Account Opening Process: The process of opening a 3-in-1 demat account should be simple and hassle-free. The broker should provide clear instructions and guidance on the account opening process, and the process should be completed quickly.

- Research and Analysis: A good broker should provide access to research reports and market analysis tools to help you make informed investment decisions. This may include daily market updates, stock recommendations, technical analysis, and fundamental analysis.

Choosing the right 3-in-1 demat account is an important decision that can have a significant impact on your investment journey. Consider the factors mentioned above and choose a broker that meets your investment goals and preferences. Always do your due diligence and research multiple options before making a decision.

Conclusion:

A 3-in-1 demat account is a convenient and seamless way to invest in the stock market. The account combines a trading account, a demat account, and a bank account, making it easier to manage your investments. ICICI Direct, HDFC Securities, and Kotak Securities are some of the best brokerage firms in India that offer a 3-in-1 account. When choosing a brokerage firm, make sure to consider the fees, customer service, research and analysis tools, technology, account opening process, and security measures offered by the firm.

Which is the best 3-in-1 account in India?

There are many trading account options available in India, and the best one for you will depend on your specific needs and preferences. Some popular 3-in-1 account options in India include ICICI Direct, HDFC Bank, Kotak Securities, and Axis Direct. Each of these options has its own unique features, benefits, and drawbacks, so it’s important to do your research and compare the different options available. Factors to consider when selecting a 3-in-1 account include brokerage fees, account opening charges, minimum balance requirements, and the quality of customer service. It’s important to carefully evaluate these factors to determine which 3-in-1 account is the best fit for you.

Is Angel One 3 in 1 account?

Yes, Angel One offers a 3-in-1 account in India that combines a savings account, a demat account, and a trading account. This allows customers to invest in stocks, mutual funds, IPOs, and other financial instruments through a single account.

Does HDFC have 3-in-1 account?

Yes, HDFC Bank offers a 3-in-1 account in India that combines a savings account, a demat account, and a trading account. This allows customers to invest in stocks, mutual funds, IPOs, and other financial instruments through a single account.

Which is the No 1 trading account in India?

There are many trading account options available in India, and the best one for you will depend on your specific needs and preferences. Some popular trading account options in India include Zerodha, Upstox, ICICI Direct, HDFC Securities, and Sharekhan.

Each of these options has its own unique features, benefits, and drawbacks, so it’s important to do your research and compare the different options available. Factors to consider when selecting a trading account include brokerage fees, account opening charges, minimum balance requirements, the quality of customer service, and the types of financial instruments you want to invest in. It’s important to carefully evaluate these factors to determine which trading account is the best fit for you

Does Zerodha have 3 in 1 account?

No, Zerodha does not offer a 3-in-1 account in India. Instead, Zerodha offers a combination of a trading account and a demat account, allowing customers to buy and sell stocks, mutual funds, IPOs, and other financial instruments. However, customers need to link their Zerodha account with a separate bank account to transfer funds for trading activities. It’s important to note that a 3-in-1 account combines a savings account, a demat account, and a trading account in a single account, whereas Zerodha offers a trading and demat account combination.