What is the difference between discount brokers and full-service brokers in India?

Discount Broker Vs Full-Service Broker– Which one is best for you? Any stock market transaction, whether it’s a purchase or sell, needs the involvement of a broker. To find the finest broker, we must first learn the fundamentals of the stock market. They act as a liaison between the stock market and the public. Stock Brokers are members of the Security and Exchange Board of India-regulated exchanges (SEBI).

Start Investing In stocks with India’s Best stock broker

In the Indian stock market, there are two types of brokers.

Discount Broker Vs Full-Service Broker – Pros & Cons

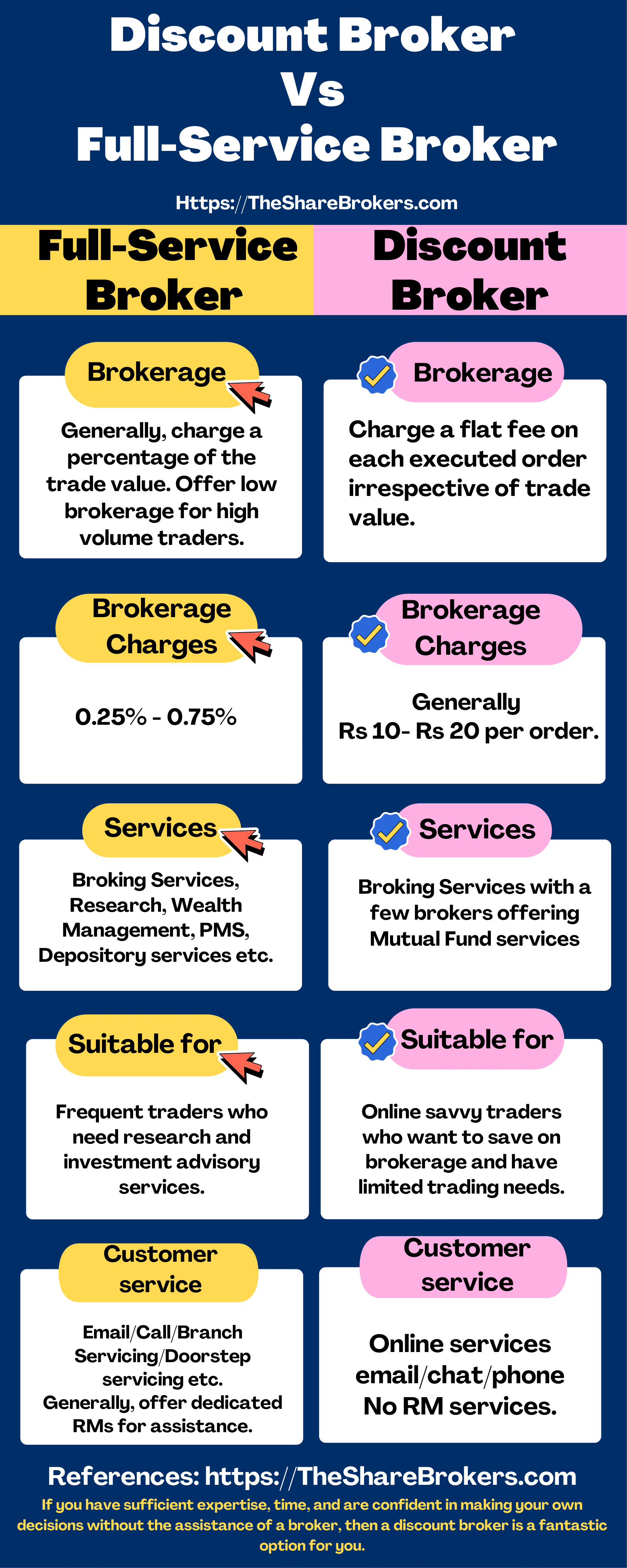

1. Define Discount Broker:

When compared to a full-service broker, Discount Broker offers the most affordable, low-cost brokerage for buying or selling socks. They are low-cost brokers who are technology-driven. They solely provide stock market players with a trading platform, but no consulting services.

When you employ a Discount Broker service, you are virtually on your own and don’t have the luxury of having someone to advise you. In comparison to full-service brokers, bargain brokerage firms charge 60% less in fees. They also provide all consumers with free online trading software.

Zerodha, 5Paisa, and Upstox are the most popular discount brokers.

Advantages and Disadvantages of Discount Brokers:

| Pros | Cons |

|---|---|

| When compared to full-service brokers, provide lower brokerage fees. | There is no research advice or other investing services available. |

| All trader types, whether low volume or big volume, have the same brokerage plan. | There are no branch services available. |

| Transaction costs are low. | There is no support for RM. |

2. Define Full-Service Broker:

This type of broker offers research, trading, and consulting services in stocks, commodities, currencies, mutual funds, initial public offerings (IPOs), insurance, and tax advice, among other things. They have a number of offices and locations around the country where customers may go if they have any questions.

Client-focused relationship managers, advising, tailored assistance, portfolio management, financial planning, and wealth management services are all available. Because advice costs a significant portion of the full-service broker’s cost, the commission charged by the full-service broker is more than the fee charged by the discount broker.

Fundamental reports and technical calls for investors and traders are provided by the full-service broker. Full-service brokers may also have their own banking and Demat accounts.

ICICI Direct, Motilal Oswal, Angel Broking, Sharekhan, Edelweiss Broking, and other full-service brokers are among the most popular.

Advantages and Disadvantages of Full-Service broker:

| Pros | Cons |

|---|---|

| Both online and offline services are available. | Brokerage fees are more expensive. |

| Provides investment advisory and other services. | Traders’ brokerage plans differ, with large-volume traders receiving cheaper fees. |

| Multiple sites for branch offices | The expenses of transactions are higher. |

| Support from a dedicated RM |

How to choose between a discount broker and a full-service broker:

It is essential that you choose a stockbroker who is compatible with your trading need.

- If you don’t have much money to invest in the stock market and can’t afford to pay high fees and commissions.

- You enjoy conducting your own research and making your own investment decisions.

- You’re skilled at figuring out how to use various tools and resources to gain the knowledge you need to make sound financial decisions.

If you fall into one of the following categories, you might consider using bargain brokers.

Alternatively:

- If you are new to the stock market and require assistance at every step.

- You have enough money to qualify for the slightly lower costs that some full-service brokers provide to their most valuable clients.

- You don’t have a lot of time to conduct research and find a suitable trading opportunity.

If you fall into one of the following categories, a full-service broker is ideal for you.

Conclusion

If you have sufficient expertise, and time, and are confident in making your own decisions without the assistance of a broker, then a discount broker is a fantastic option for you.

On the other hand, if you are new to the market and are willing to pay a higher commission for advising services in order to save time, you should consider using a full-service broker.

The decision to utilize a brokerage firm is solely based on personal needs and tastes. To make the best decision as a new investor in the stock market, the aforementioned factors must be considered.