As an investor, it is natural to be concerned about the integrity of your stockbroker. You might wonder whether your stockbroker can cheat you and engage in fraudulent activities to enrich themselves at your expense. While such cases are rare, it is not entirely impossible for a stockbroker to cheat you.

In this article, we will discuss the ways in which a stockbroker can cheat you and what you can do to protect yourself.

Ways in which a stockbroker can cheat you

- Churning:

Churning is a practice in which a stockbroker makes frequent trades in your account to generate commission fees. The broker might make trades that are not in your best interest, and these trades can lead to unnecessary losses. To prevent churning, you should monitor your account statements regularly and ensure that your broker is not making excessive trades.

- Unauthorized trading:

Unauthorized trading is a practice in which a stockbroker buys or sells securities in your account without your permission. This can happen if the broker has access to your account details, such as your username and password. To prevent unauthorized trading, you should keep your account details safe and change your password frequently.

- Misrepresenting investment products:

Stockbrokers might misrepresent investment products to make them seem more attractive than they actually are. They might exaggerate the potential returns of a product or fail to disclose the risks associated with it. To protect yourself from this type of fraud, you should do your own research before investing in any product and ensure that you fully understand the risks involved.

- Insider trading:

Insider trading is a practice in which a stockbroker uses non-public information to make trades for their own benefit. For example, a broker might purchase stocks in a company based on information that is not available to the public, such as a pending merger or acquisition. Insider trading is illegal, and if your broker engages in this activity, they can face severe penalties.

How to protect yourself from stockbroker fraud

- Choose a reputable broker:

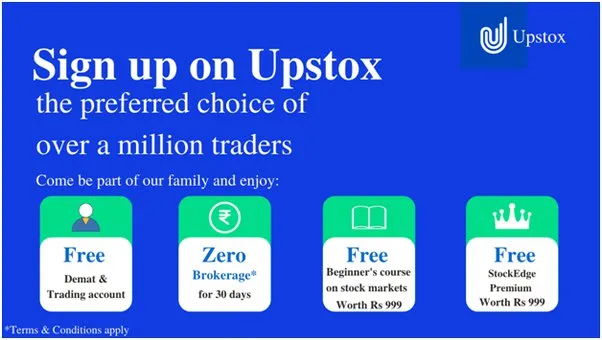

One of the best ways to protect yourself from stockbroker fraud is to choose a reputable broker. Look for brokers who are registered with the Securities and Exchange Board of India (SEBI) and have a good reputation in the industry.

- Read your account statements carefully:

Read your account statements carefully and look for any suspicious activity. If you notice any unauthorized trades or excessive trading activity, report it to your broker immediately.

- Keep your account details safe:

Keep your account details safe and change your password frequently. Do not share your username or password with anyone, and avoid using public Wi-Fi networks to access your account.

- Do your own research:

Do your own research before investing in any product. Read the prospectus carefully and ensure that you fully understand the risks involved. If you have any doubts, consult a financial advisor before making any investment decisions.

- Report any suspicious activity:

If you suspect that your broker is engaging in fraudulent activity, report it to the SEBI immediately. You can also file a complaint with the National Stock Exchange (NSE) or the Bombay Stock Exchange (BSE).

Conclusion:

While stockbroker fraud is rare, it is not entirely impossible. Churning, unauthorized trading, misrepresenting investment products, and insider trading are some of the ways in which a stockbroker can cheat you. To protect yourself from fraud, choose a reputable broker, read your account statements carefully, keep your account details safe, do your own research, and report any suspicious activity to the SEBI, NSE, or BSE. Remember, it is always better to be safe than sorry when it comes to your investments.